Dollar lower, risk shrugs off stimulus worries

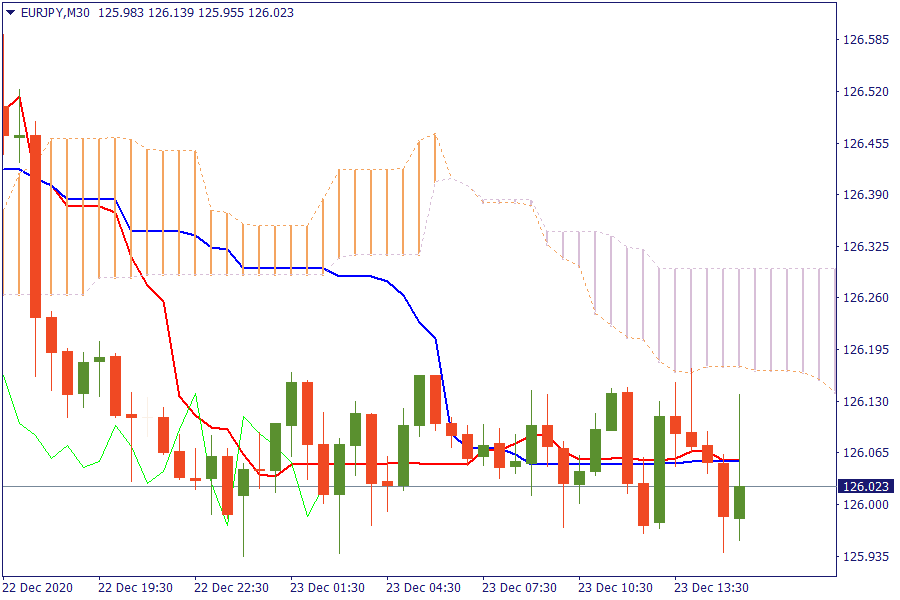

Ichimoku Kinko Hyo

EUR/JPY: The pair is trading below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

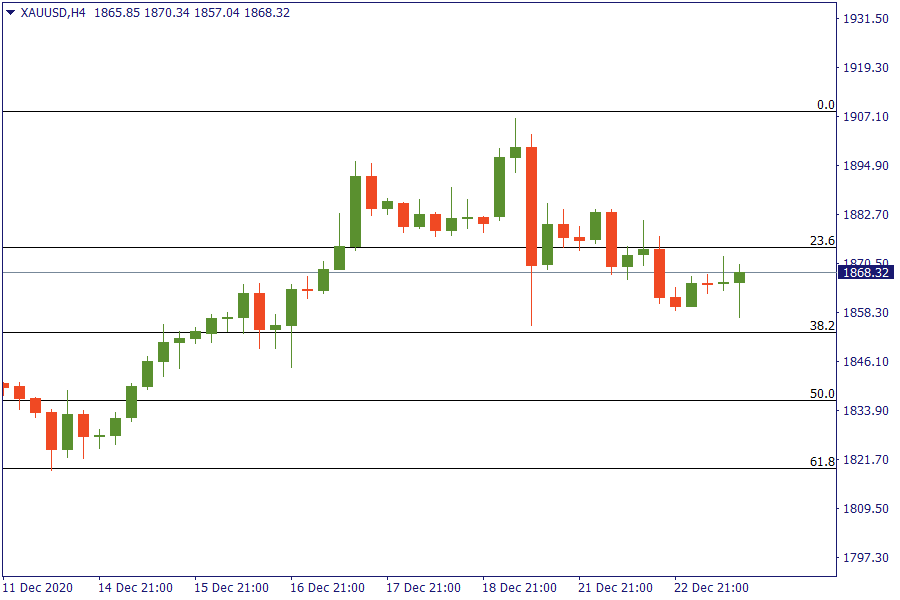

Fibonacci Levels

XAU/USD: Gold bulls try to remain above the critical retracement area of 38.2%.

US Market View

U.S. stocks are set to open moderately higher, with signs of the market slowing down ahead of the Christmas holiday. France agreed to reopen its border with the U.K., after sealing it at the weekend in response to the discovery of a new and more contagious variant of the Covid-19 virus.

Crude oil prices edged higher overnight, rebounding after a surprise build in U.S. inventories last week. The American Petroleum Industry estimated that crude stockpiles rose 2.7 million barrels last week, the sixth straight weekly increase and the biggest in four weeks

USA Key Point

- EU member states have started to prepare for provisional application of UK deal

- US November prelim durable goods orders +0.9% vs +0.6% expected

- Canada October GDP +0.4% m/m vs +0.3% expected

- The NZD is the strongest and the CHF is the weakest