Recession: "The Worst is Yet to Come" - IMF Chief Economist

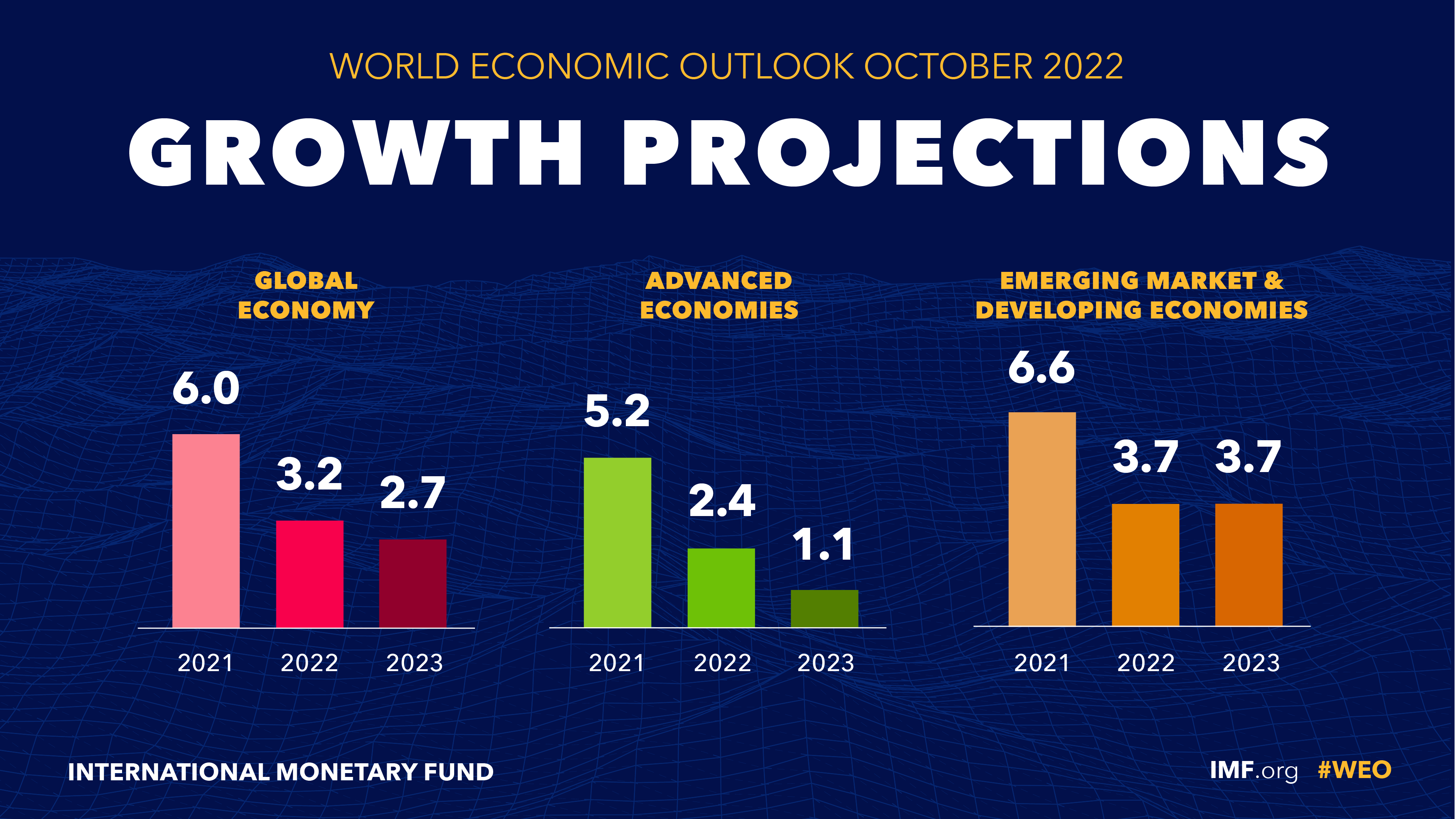

Last week, Pierre-Olivier Gourinchas, the IMF's chief economist, commented on the IMF's global economic outlook, stating clearly that the worst was yet to come. For many people, he opined that the year 2023 would feel like a recession.

The IMF has also warned of an irregular repricing in markets which has led to the conclusive increase in global financial stability risks, which may spread and spill over into other markets due to the combined pressures from food crises, war-driven energy costs (scarcity), inflation, and higher interest rates, thus, driving the world closer to a global recession.

Outlook for Traders

As of 13th October 2022, world stocks dipped nearly below the 2-year low, with the Japanese yen slipping even lower to the 1998 lows. OPEC has decided to cut down on oil production, which could raise oil prices to new highs, hastening a possible global recession.

What to Trade

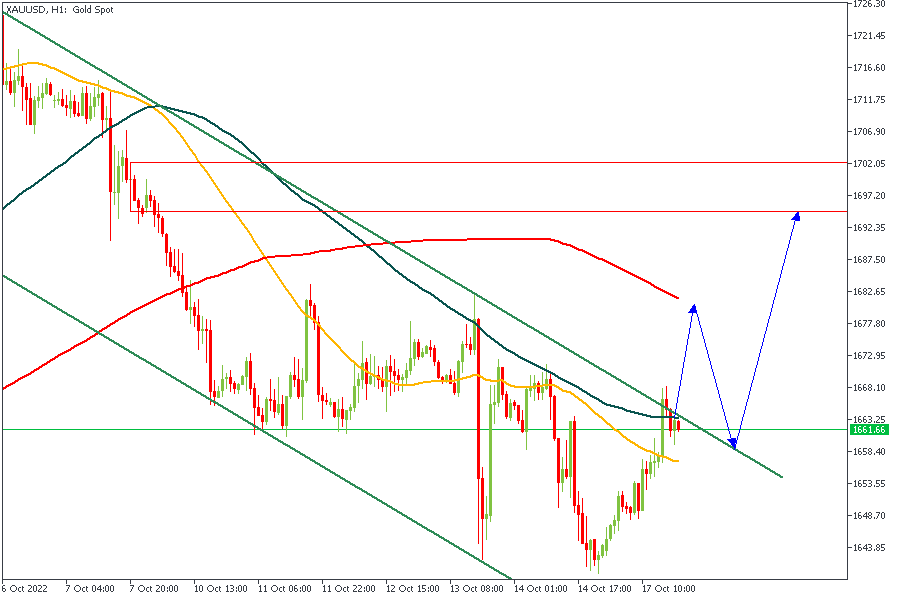

In times like these, more investors and commercial banks will be leaning towards safe-haven commodities in hopes of capital preservation rather than growth. Thus, there could be more bullish movements on assets like XAUUSD and OIL.

All eyes are on XAUUSD for a possible breakout and retest of the descending channel which should signal the start of a bullish rally.