The key levels for the South African Rand this week

The South African currency was named as one of the most volatile emerging-market currencies by some analysts and its recent behavior may prove this statement. After the bullish start of the year, the rand has started to weaken since the last Thursday. Let’s point out the main factors affecting the ZAR and set the key levels for this week’s trading.

Local factors

The key event in South Africa which pushed USD/ZAR higher is the rate decision by the South African Reserve bank. The central bank left its interest rate unchanged at 6.75% on Thursday and projected only one rate hike by the end of 2021. Back in November, the Reserve bank suggested three increases of the rate by the end of 2020. The reason behind this cautious tone is connected with the changes to the inflation outlook by the bank. According to December’s forecasts, the level of inflation was expected to reach 5.5% in 2019. This time, the SARB cut its inflation expectations to 4.8%. The bank wants to keep the level of inflation under control within the 3-6% range. A slower pace of the rate hikes and falling inflation will support the South African economy during the global pressures. At the same time, the ZAR will be pulled lower.

Global factors

Let’s not forget about the global market. As the South African rand is a risk-weighted currency, it is heavily affected by the sentiment in the market. The recent risk aversion was created after the news about the global economic slowdown. The slowdown happened as a reaction to the political and economic uncertainties in the world. At first, the Brexit deal proposed by the British Prime Minister Theresa May was rejected last week and no alternatives to the current plan have been suggested yet. Secondly, the trade negotiations between the US and China have not reached any breakthrough to some of the highly important topics, including the US demand to solve the intellectual property rights issue. In addition, the news on China's lowest economic growth in 30 years made the investors worried and increased the risk-off sentiment. The forecasts by the International monetary fund prove the signs of the slowdown as the IMF Chair cut the global growth forecast for 2019 from 3.5% to 3.7% on Tuesday.

The global situation motivates spooked investors and traders to drive their money into the safe-haven currencies such as the USD and the JPY. It made the greenback and the Japanese yen outperform against other currencies and, therefore, pull the South African Rand to retest lower grounds.

What will support the ZAR this week?

The economic calendar does not contain any important data for the USD this week, that is why it is recommended to pay attention to the headlines. The positive updates on the trade truce between the US and China will create the risk-on sentiment in the market and support the ZAR.

Let’s take a look at the key levels for USD/ZAR.

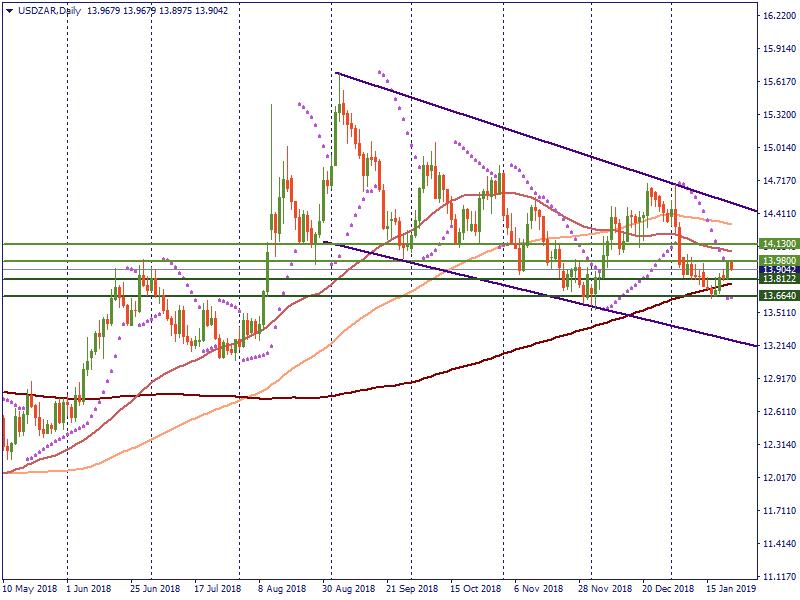

On the daily chart, the pair has been making gains towards the 13.98 level. If the pair manages to break the resistance, the next resistance is placed near the 50-day MA at 14.13. Despite the upward momentum, the trend is still bearish according to the Parabolic SAR. If USD/ZAR reverses, it will fall to the support at 13.8122. If this level is broken, the next support lies at 13.6640.

Conclusion

Despite the current weakness of the South African rand due to the global pressures, the technical indicators show the ZAR may continue to strengthen. The news will determine the future direction of the pair.