Three scenarios for trading on coronavirus pandemic

The oil prices update fresh lows, safe-havens rise, and stocks keep plunging. It took one month to pull the American stock indices from the all-time highs to the levels of 2017. S&P and Goldman Sachs are now sure that we are heading towards the recession. Central banks are trying to do their best to support economies during uneasy times. However, their traditional tools seem useless for now while most of the activities and production remain shut. Taking into account all the facts, analysts from Saxo Bank considered three possible scenarios of how things can develop from here.

To begin with…

Take note that the cases described below may not be 100% accurate and none of them may come to live. Still, they may provide a good representation of the upcoming times and may help us choose the right trading tools.

Regardless of any scenario, there are two key rules a trader should follow right now: be attentive to the risk management and have liquid funds when the market experiences significant damage. Look at the example of Warren Buffet: his cash levels have increased recently.

Analysts compared the three scenarios with geometric shapes. Depending on the development of the situation, they may be V-shaped, U-shaped or L-shaped, where V-shape is the best one and L-shape is the worst one.

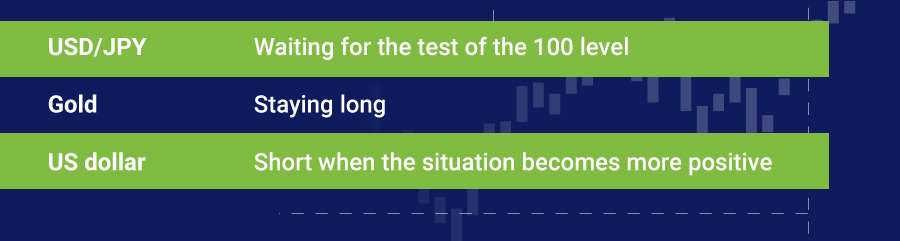

The best scenario: a delayed V-shape

In this case, we still expect a global technical recession and an economic slowdown in Q2 and Q3. At the same time, quarantine measures are expected to bring positive results and to slow the spreading of the virus. Therefore, the fiscal stimulus and massive rate cuts will start to bear fruit from this point and generate a V-shaped rebound in the third or the fourth quarter. Also, a positive announcement that could evolve in the V-shape scenario is the development of a new vaccine, which will be available to most of the population. In the picture below, we considered the main trading ideas for this kind of outcome.

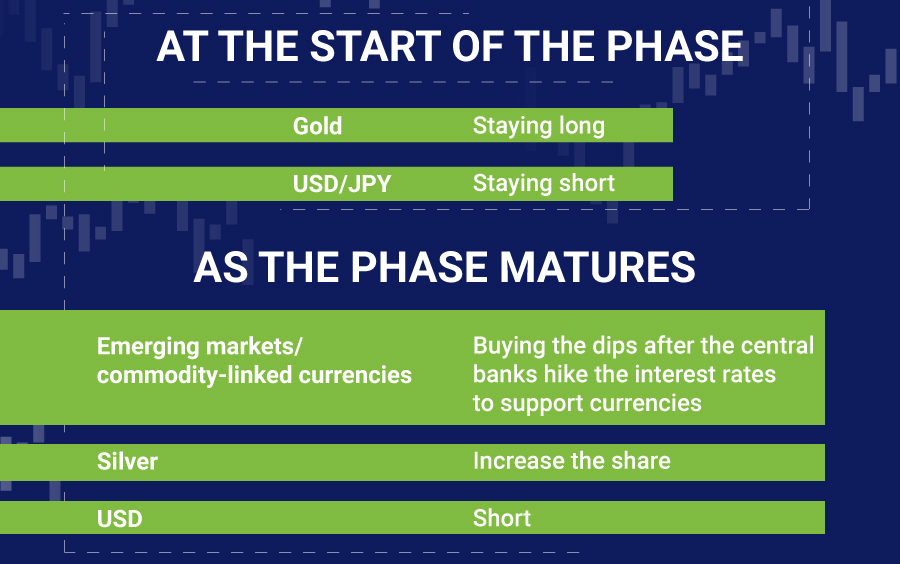

The base scenario: a U-shaped recovery

This scenario is based on the long-term quarantining in different countries, leading to the reduction of public activity and a sharp recession. Despite several stimulus measures by central banks, the real activity would remain under pressure with reinfection and quarantine policies. Thus, we may expect a recovery here taking a longer time than in the "best" scenario, due to the lack of supply in the energy and manufacturing sectors. Here are the trading plans for this type of scenario:

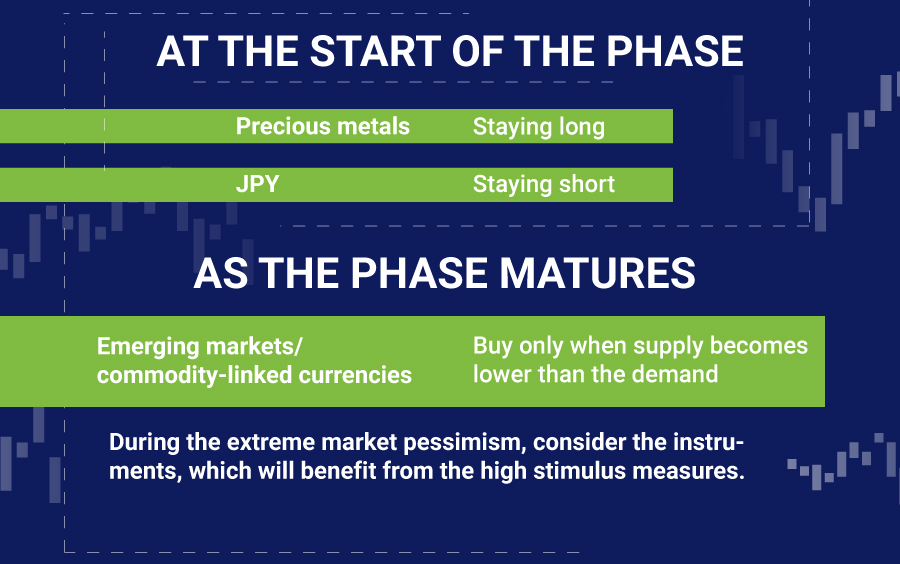

The worst scenario: an L-shaped recovery

If the events lead us to this outcome, we will see the global GDP going to the lowest levels since the Great Depression of the 1930s. The virus will continue spreading and increase reinfection fears. All the small and medium enterprises would be at risk, as they will be lacking financial support. It will also lead to high unemployment levels and low levels of business activity. The signs of recovery here are not expected until 2021.

For sure, we don't want the third scenario coming to life, but we need to be prepared for everything. Follow the market, read the news and see the hints on the possible changes in the situation. Once all the risks are diminished, you will be one of those who know how to take advantage of the situation.