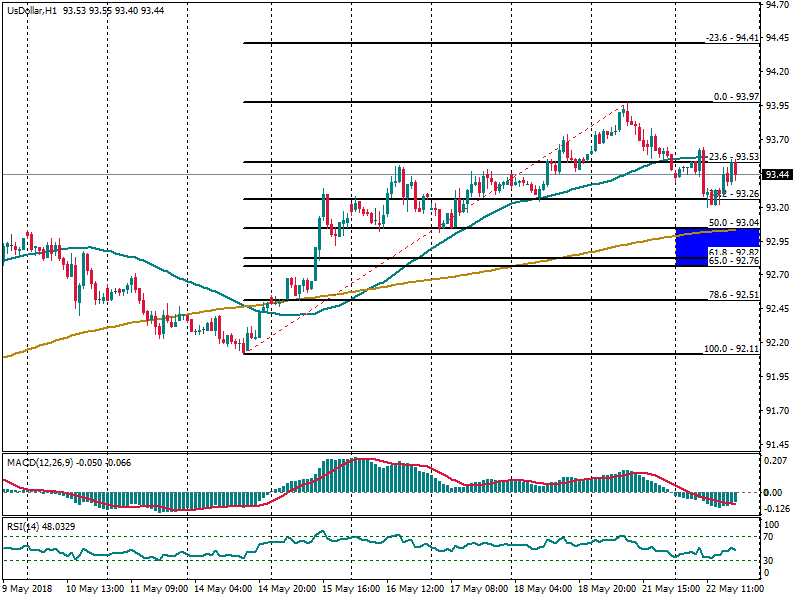

US Dollar moving inside a corrective phase

US Dollar has been trading in a corrective phase across the board and it seems we can expect further consolidation below the 50 SMA at H1 chart. Now, the focus is placed at the 200 SMA, where the Fibonacci level of 50% at 93.09 lies. A breakout below there should open the doors for a free fall towards the lows from May 14th at 92.11. However, a rebound should take it to test the Fibonacci area of -23.6% at 94.41.

RSI indicator stays in the neutral territory, favoring to the sideways consolidation.