USD: Focus Shifts To Retail Sales & PPI

Ahead of the release of US February Retail Sales data, the US Dollar (USD) is showing a modest recovery. Analysts at BBH assess the potential impact of the upcoming data on the USD. A soft reading in spending could prompt another downward correction in the USD, as it might indicate a weakening consumer sentiment. Market expectations suggest a rebound in Retail Sales by 0.8% month-over-month (MoM) in February, following a 0.8% decline in January. Additionally, the Control Group Retail Sales, which exclude certain categories and feed into GDP calculations, are expected to rise by 0.4% in February after a 0.4% decline in the previous month. A robust performance in US consumer spending could dampen expectations of Fed funds rate cuts and bolster the USD, while any signs of spending struggling under higher interest rates may lead to a downside correction in the currency.

USDCAD - H1 Timeframe

The 1-hour timeframe chart on USDCAD is currently showing signs of a likely reversal. However, the fact that the price action has failed to break the previous high, or the trendline resistance could indicate a continuation of the bearish pressure in the meantime.

Analyst’s Expectations:

Direction: Bearish

Target: 1.34501

Invalidation: 1.34957

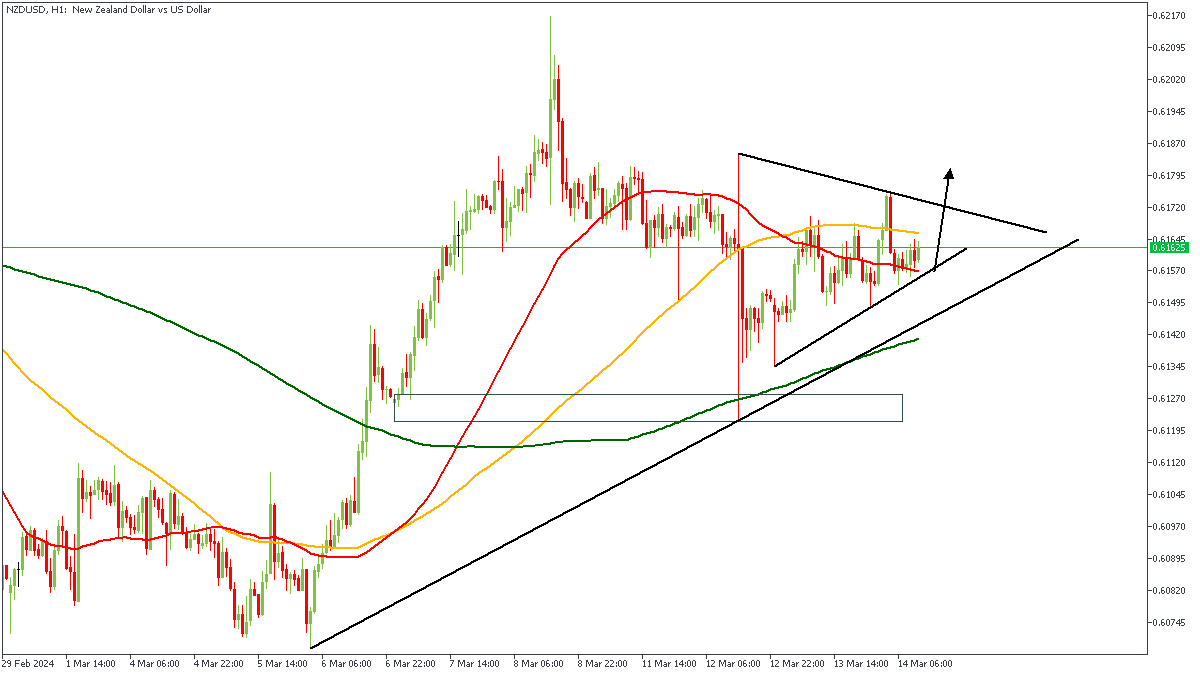

NZDUSD - H1 Timeframe

There are visible signs of consolidation on the 1-hour timeframe chart of NZDUSD. The wedge pattern is supported even further by the presence of a second trendline support, which aligns perfectly with the 200-period moving average. As a result of these confluences, my sentiment on NZDUSD is bullish.

Analyst’s Expectations:

Direction: Bullish

Target: 0.61922

Invalidation: 0.61476

USDJPY - H1 Timeframe

USDJPY has had a long streak of bearish momentum for weeks now with the most recent high remaining unbroken as yet. Considering the presence of a trendline resistance, Fibonacci retracement level, and the bearish array of the moving averages, I stand convinced that the bearish price action may continue.

Analyst’s Expectations:

Direction: Bearish

Target: 147.403

Invalidation: 148.206

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.