XAUUSD: Will Prices Soar Higher?

Gold prices bounced back on Wednesday, reaching $2,173.60 after briefly dipping to $2,150.00. Traders speculate that the US Federal Reserve (Fed) might reduce borrowing costs, but a recent report showing higher-than-expected inflation in the US could delay such actions. Despite signs of a cooling labor market, the US economy remains robust, with inflation staying above 3.2% in the twelve months to February. Fed Chair Jerome Powell stated last week that policy easing is possible if conditions allow, but the Fed remains data-dependent and cautious about starting a trimming cycle. Meanwhile, the XAU/USD remains in positive territory, despite a slight increase in the US 10-year Treasury bond yield to 4.19%.

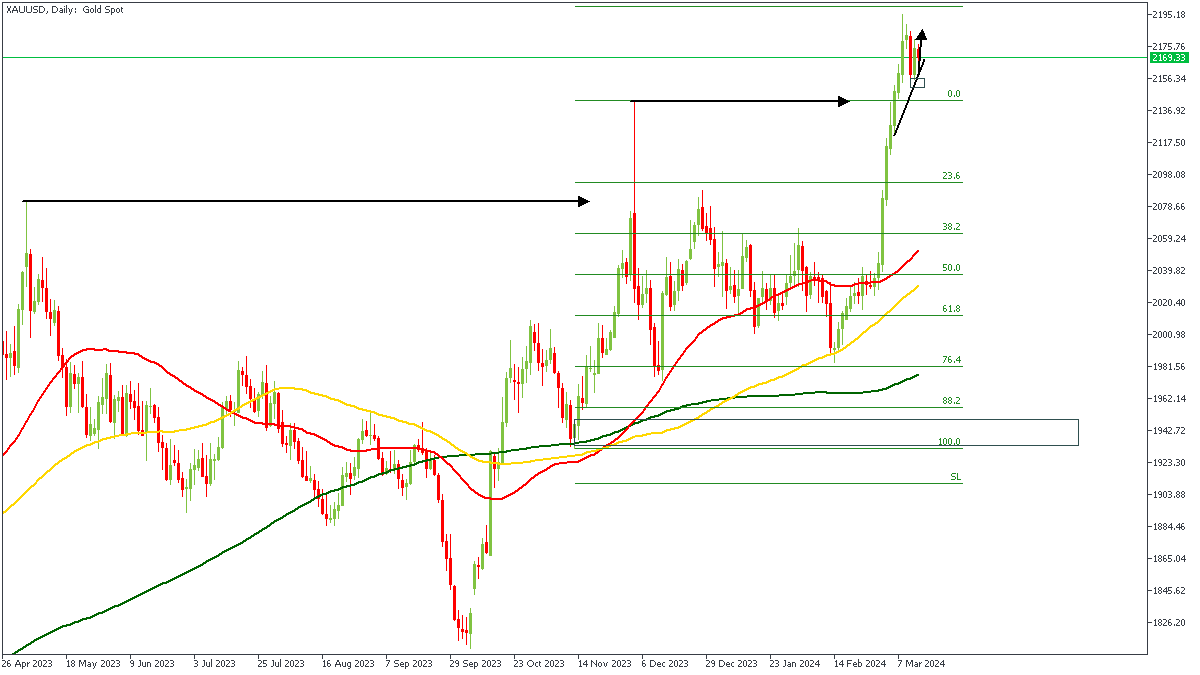

XAUUSD - D1 Timeframe

On the daily timeframe of XAUUSD, we can clearly see that the structure has been broken, with price shooting clear of the previous high. In line with this, we also see that the moving average array on the daily timeframe remains clearly bullish.

XAUUSD - H1 Timeframe

On the 1-hour timeframe, we see price gliding towards the trendline support, as well as the 200-period moving average. There is also a notable demand zone just below the trendline support. Comparing the price action on the 1-hour timeframe with that of the daily timeframe, I believe it’s quite clear that the sentiment is bullish - and the reason(s) why. Do note, that a break below the trendline and the demand zone could indicate the onset of renewed bearish vigour.

Analyst’s Expectations:

Direction: Bullish

Target: $2,181.88

Invalidation: $2,149.59

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.