FBS AI Assistant feature is used to create an AI-generated chart analysis to boost your trading. It is free to use, providing up to 15 reports per day. The AI Assistant is integrated directly into the chart, making it easy to access and use.

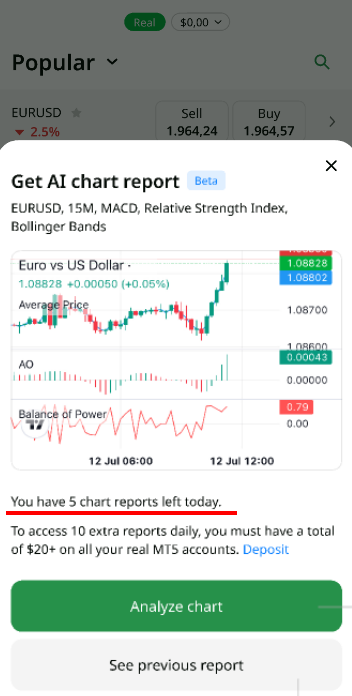

All users have access to 5 free reports per day. To get an additional 10 reports (a total of 15), the total sum on all your trading accounts should be $20 or more.

To get a report, you need to open the chart you want an analysis of and click on the stars button to access the AI Assistant:

In the pop-up window, you will see the remaining number of your reports for today, create a new report, and access the previously generated one. Please note, that you can access only the last report, the ones created before that will be deleted automatically.

To receive your report, please, click on the “Analyze chart” button, and your report will be generated within 7-15 seconds. The full report appears in the same window.

You can also open an order based on the AI predictions directly from the report page, by using the button “Place order” under one of the “Trade ideas” at the end of the report.

Important! Please, note that our AI-generated analysis is not financial advice. Always conduct your own research before trading.