Most traders are familiar with the idea of buying stocks, hoping that their value will rise. But what if there was a way to profit even when stocks go down? That’s where short selling comes in. Short selling is basically betting against the market. It’s a strategy that allows traders to bet that the price of a stock will fall.

In this article, we will break down what short selling is, how it works, what shorting a stock means, what the risks and benefits of short selling are, and how traders can use this strategy to their benefit. We will also shed some light on the possible advantages and risks associated with betting against the market in this way.

Understanding short selling

Unlike the common strategy of buying a share and waiting until its value increases, short sellers hope for a market decline in order to buy the stock back at a better price.

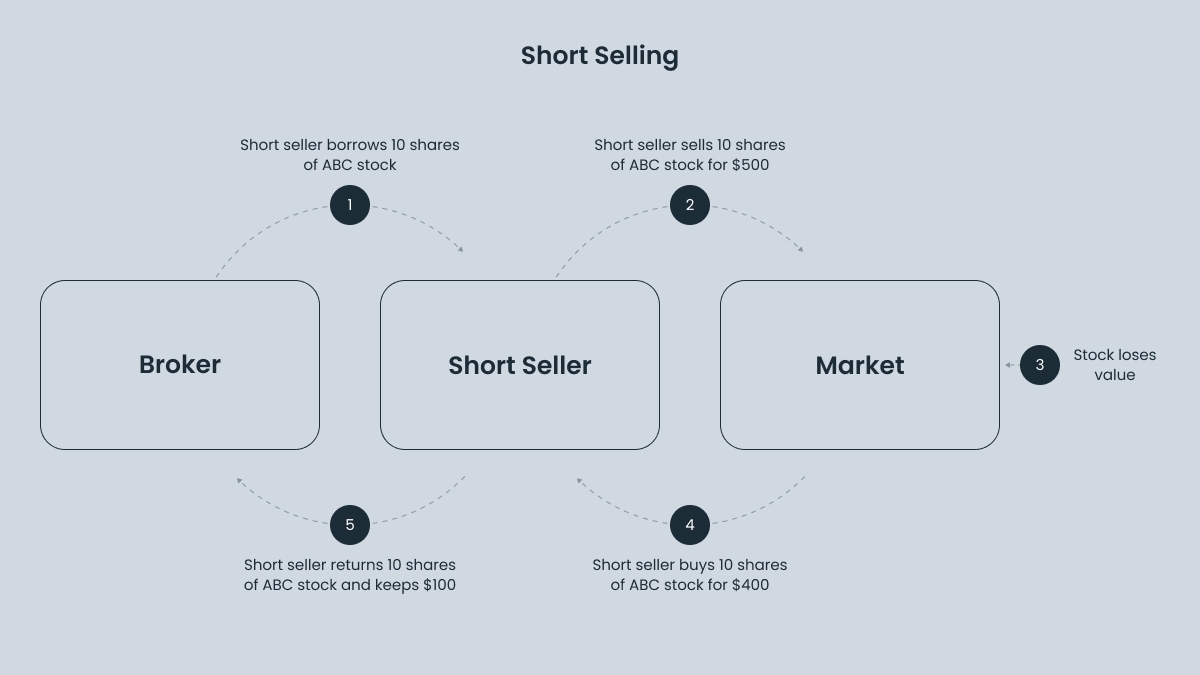

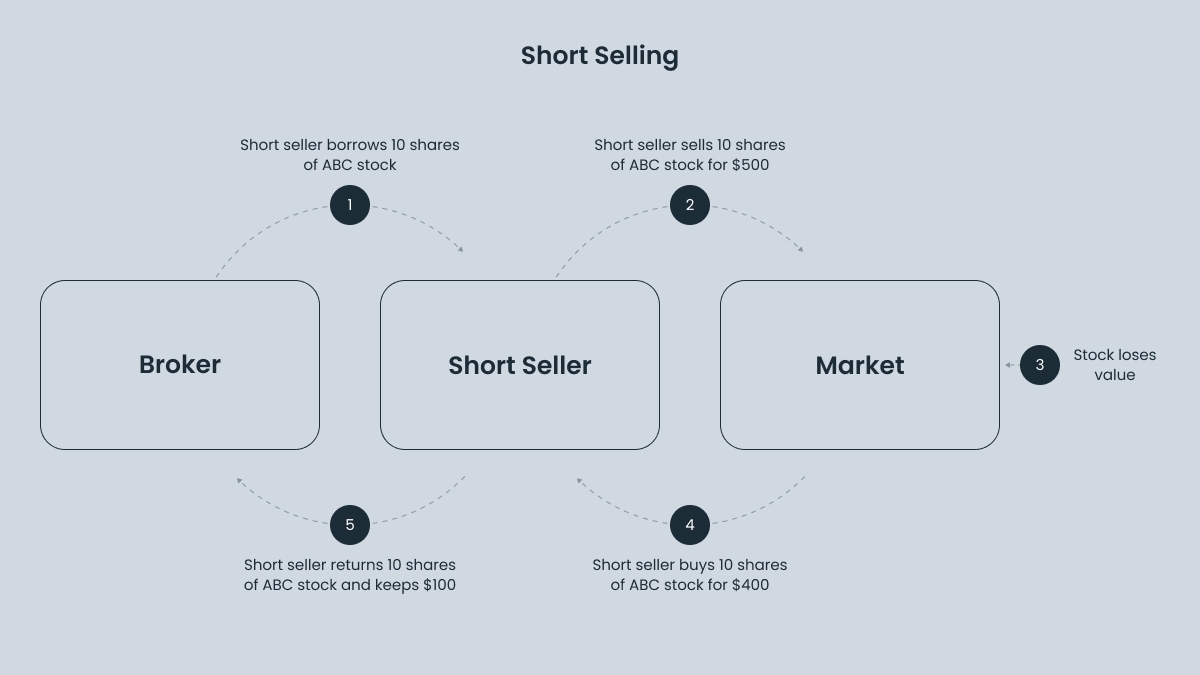

Traders can't sell stocks they don’t own, so they borrow them from a broker. The trader then sells the borrowed stocks and later buys them back to return to the broker. All the profit from the transactions — minus the commission and the fee for using the broker’s stocks — remains with the trader. However, the loss from unsuccessful transactions is also on the trader’s shoulders.

Therefore, when employing short selling, traders borrow shares they don’t own, hoping that their price will go down, and then sell them to buy back later, hopefully at a lower price than what they had sold them for, if everything goes according to plan.

Rough economic times are great for short sellers.

Let’s look at an example:

If an investor borrows 100 shares of a stock trading at $50 each, they sell them for $5000. If the stock drops to $40, they can repurchase the 100 shares for $4000, pocketing a $1000 profit. However, this strategy comes with significant risks, including the potential for unlimited losses if the stock price rises instead of falling.

You can use a margin call in leveraged trading. If you come up short, the broker uses your funds or selling some of your assets to buy back the asset.

Be aware of margin requirements and beware of short squeezes.

How to identify the perfect time to sell short

Short sellers rely on technical analysis and indicators to identify bearish trends and gauge market momentum. Here are two indicators particularly useful for short selling:

Bears power indicator: Developed by Alexander Elder, this indicator measures the strength of bears (sellers) on the market. It analyzes the difference between the lowest price and the exponential moving average (EMA) of a given period. When the bears power indicator shows increasingly negative values, it signals strengthening bearish momentum—an ideal condition for short selling.

Average true range (ATR): Introduced by J. Welles Wilder Jr., ATR measures market volatility by analyzing the full price range of an asset over a specific period. A high ATR indicates significant price movement, which is useful for setting stop-loss levels and understanding potential price swings in volatile markets.

Other indicators like the relative strength index (RSI), moving averages, momentum, and MACD (moving average convergence divergence) can also enhance a short-selling strategy by helping traders identify overbought conditions, price reversals, or weakening trends.

Short selling requires a disciplined approach. Combine technical analysis with a clear risk management strategy to limit potential losses. Pay attention to market conditions, especially events like earnings announcements or regulatory changes, which can quickly reverse a bearish trend.

Short selling can be a powerful tool for traders that keep in mind risk management tactics and have a clear strategy.

Simple strategies for short trading

Short positions require more careful selection than long ones. Before entering a trade, it is necessary to assess the risk and outline at what price the position will be closed with a profit and at what price it will be closed with a loss.

To reduce risks, experts recommend that beginner short sellers focus on periods when the overall market is declining. It’s also advised that you don’t borrow too much and to avoid using maximum leverage.

Risk management is key, and traders must remember to set stop orders. Additionally, it’s beneficial to study technical analysis and trading decision-making methods.

Some stocks rise due to upcoming dividends. If a company announces dividends higher than the key interest rate, it’s better to avoid short positions on those stocks as the risk of losses increases.

Also, shorting a stock during the dividend gap won’t be profitable. When the dividend cut-off occurs, brokers will withhold an amount equivalent to the dividend value from the investor’s account.

How to short stocks

1. Open a margin account

If you want to sell short, the first thing you need is to open a margin account with a broker. This will allow you to borrow the stocks you wish to. It’s a good practice to keep some collateral amount in your account — usually about 150% of the value of the stocks you’re shorting. This means if you plan to short $10 000 worth of stock, you’ll need to have $5000 in your account as collateral.

2. Pick a stock to short

Once you have your margin account, it’s time to pick a stock you think is overpriced and likely to drop in value. This will require some research and market analysis.

Suppose you think Company A is about to see its stock price fall. You decide to short 300 shares at $30 each, so you’re betting that the stock will drop. To cover the $9000 worth of stock you’re shorting, you need to put $4500 in your margin account.

3. Borrow the shares

Before you can short sell, your broker needs to find shares that can be borrowed. These days, brokers do this automatically by getting shares from other clients’ accounts or from larger institutional lenders.

4. Place a sell order

After traders have borrowed the shares, the broker will sell them at the current market price, and the proceeds will go into the traders’ margin account.

For example, after selling 300 shares of Company A’s stock at $30 each, you’ll have $9000 in your margin account. You’ll also need to have a $4500 deposit (which is 50% of the $9000) as collateral in your account.

5. Monitor your open position

Now, it’s all about watching and waiting, and traders must keep an eye on the stock’s price: if the price drops, it’s in a good position to profit. But if the price rises, you’ll start losing money.

For instance, after a month, if Company A drops to $25, you’ll be in a good spot. You can now buy back the 300 shares for only $25 each, totaling $7500.

6. Close the short position

To close the position, the trader simply places a buy order for the same number of shares they originally sold. Traders need to buy back the shares they borrowed and return them to the lender. This is called covering the short. Ideally, the trader buys the shares back at a lower price than what they sold them for and keeps the difference as profit minus fees or interest.

Understanding the risks

Unlimited losses

When you buy stocks, your losses are limited to the amount you invested. But with short selling, the price can keep rising, and there’s no limit to how much you could lose.

Change in borrowing fees

The cost of borrowing shares can change quickly. You might start with a 20% interest rate, but the next day, it could jump to 85%. This can make your position more expensive and less profitable.

Dividend payments

Because the short sellers don’t own the stocks or their shares, they don’t receive any dividends. Instead, any dividends paid are deducted from the trader's account and given to the stock’s owner. That’s why some short sellers close their positions before the ex-dividend date.

Margin calls

If the value of the stock trader’s short rises, their margin account might drop below the required balance. If this happens, brokers could ask for more cash or stocks to cover the difference. If traders don’t meet the margin call, the broker can close their position.

Advantages of short selling

Potential for high profits: Short sellers can make significant returns if the price drops as expected.

Low initial investment: Short selling requires less upfront capital since it’s done on margin (using borrowed funds).

Hedge against other positions: Short selling can act as a hedge to balance out other investments in your portfolio.

Historical examples of profiting from short positions

Michael Burry foresaw the mortgage market crash and bet against it, making no less than $800 Million.

Burry’s big break came when he analyzed the subprime mortgage market. He noticed that many mortgage-backed securities were built on risky loans, especially subprime mortgages for borrowers with poor credit.

Burry predicted the housing market’s collapse, noticing that mortgage defaults were rising while banks assumed the loans would continue to perform. He began betting against the market to profit from the expected crash.

Despite skepticism from his investors, Burry held firm, and in 2007, when the housing market crashed, he made $800 million—$100 million for himself and $700 million for his investors. His foresight earned him widespread recognition. Michael Lewis’s book "The Big Short" in 2010 and the 2015 film adaptation were inspired by Burry’s story.