May 23, 2025

Risk management

Trading ROI Explained

ROI stands for “return on investment” and is a financial concept that shows the profit or loss generated by an investment. This concept applies to any industry where an investment can be made and bring profit (or loss). Online trading or Forex is no exception, so let’s talk about trading ROI in this article.

When we think about return on investment in trading, we need to understand both sides — the investment and the returns. What do we consider an investment in trading? Basically, we consider any money that you bring to your brokerage account to be your investment. You use that money to open your positions. This is what we consider your investment in trading.

The balance on your trading account changes to reflect the results of your open positions — your profit or loss. You can use the two numbers to calculate your trading ROI.

How to Calculate the ROI

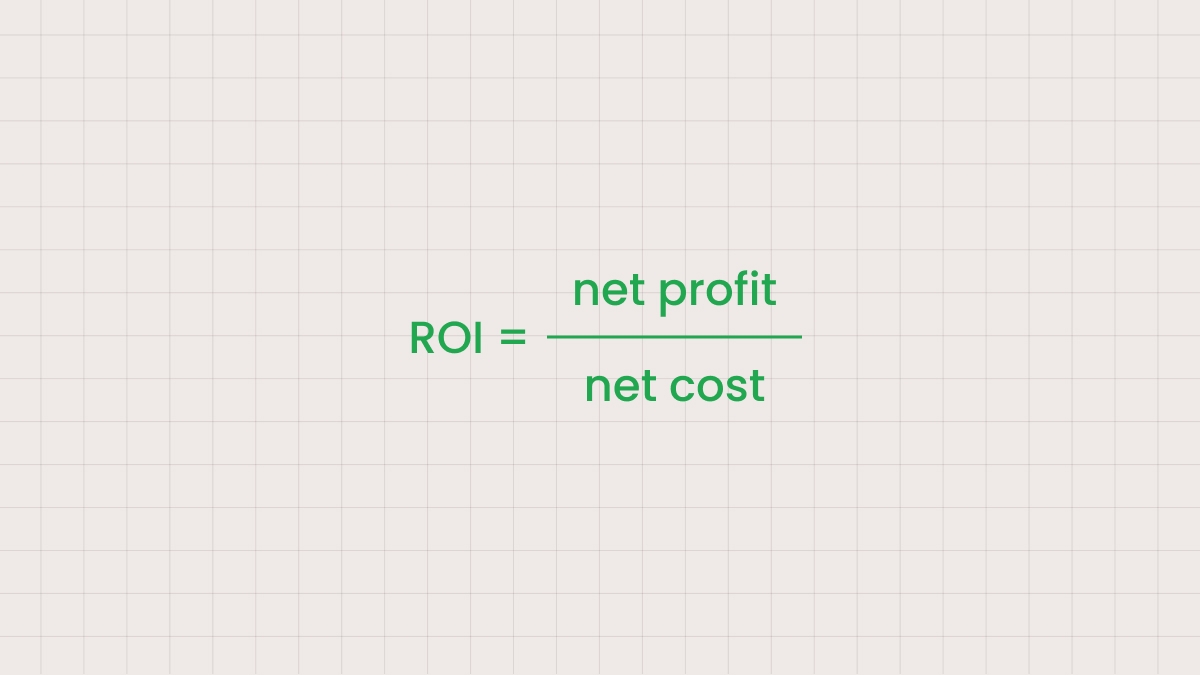

Return on investment is the percentage that lets us understand the profitability or efficiency of the investment you’ve made. It can be represented as an absolute ratio (0.3) or percentage (30%).

Here net profit stands for all the money you make over a period, while net cost is your entire initial investment, i.e. all the money you bring into a project.

A high value shows a very profitable investment, something that worked well and proved to be very efficient. And vice versa, if the number is negative, it shows the investor has experienced a loss instead of a profit.

Why is ROI important?

ROI is very important as it allows us to evaluate actual results in trading. Since ROI is calculated using a very simple formula, it is a very practical and straightforward metric that can be used by traders irrespective of their experience level.

For example, it is very hard to compare the performance of different investments in industries that are not generally easy to compare, such as stocks, real estate, or investing in an IT startup. While they cannot be directly compared because they are totally different in nature, you can still calculate the ROI for any of them and compare assets that cannot be compared otherwise.

The ROI value enables you to compare different investment vehicles to see which works better for you. For example, you may enjoy trading exotic currency pairs, but your Forex trading returns only 5%. At the same time, trading commodities (gold and crude oil) brings you an ROI of 15% for the same period. After this analysis, you will be able to change your strategy and focus your time and investments on commodities.

Besides, if you record the ROI values over a longer period, you will be able to draw further conclusions about your trading strategy and portfolio. In addition to your statistics for your open and closed positions, you will be able to see a broader picture of your overall performance.

Illustrating ROI use with an example

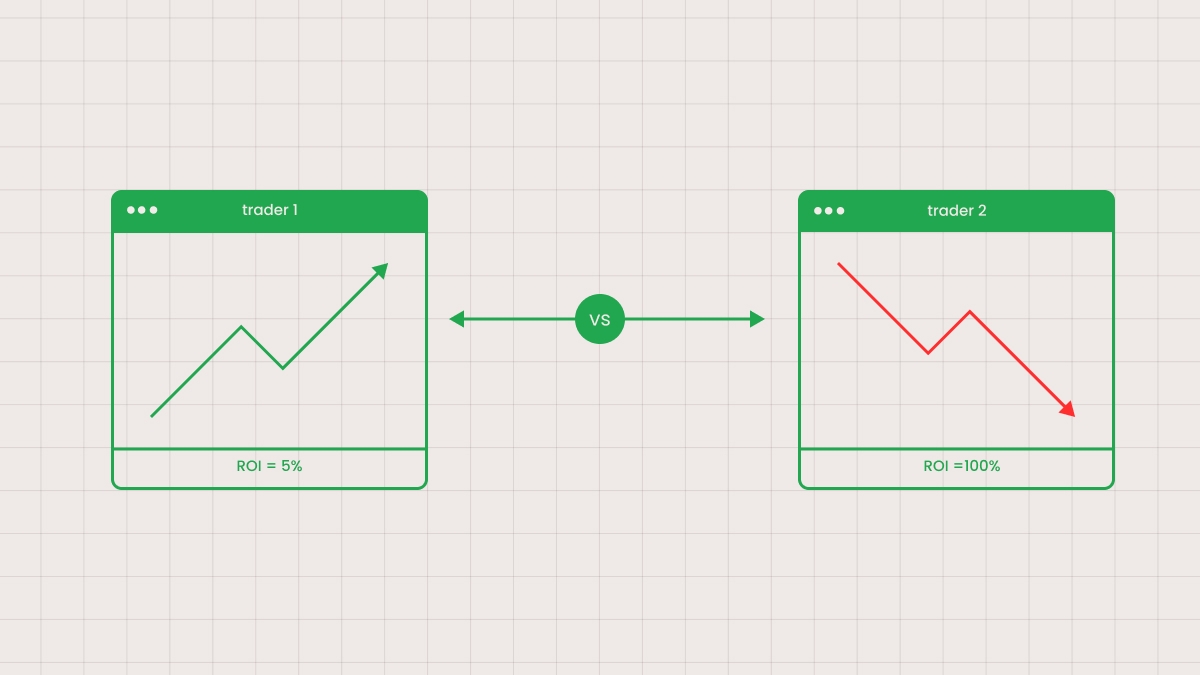

Let’s consider two retail traders with different approaches to trading.

One of them does not calculate the ROI at all and trades randomly. They open positions and only look at the results for this single position without considering the long-term profit or loss. This trader expects their initial investment to double every month. Since this is an exceptionally high ROI for trading, it does not turn out to be true for him most months. In fact, average Forex returns tend to be much lower, which is OK, since it is a financial process, not a miracle. However, this trader seems to be expecting a miracle. Eventually, they get disappointed and quit trading.

The other person trades carefully, calculates their ROI to understand the overall results, and follows their own trading strategy. This trader calculates their ROI value monthly and compares the values from month to month. Thus, this trader has very realistic expectations. This person knows when they are really making progress, so they confidently keep working toward their realistic goals. The overall result will be much better. Confidence and knowledge are absolutely required in trading.

Limitations of ROI

ROI is a very useful metric that can show a lot about your approach, your strategy, and your overall understanding of the market. However, there are certain ROI limitations that you should understand to analyze the situation better.

First of all, ROI does not consider the time value of money. To calculate ROI, you simply take your investment and compare it with the profit. The profit may look impressive, but if you take time into account, you may see the situation in a totally different light. For example, 20% ROI is great, but if it is over the course of 5 years, it is much less impressive.

Besides, ROI calculations do not consider risks at all. Risks are natural for any investment, and in Forex, return depends on risks more than in many other fields, such as real estate or bank deposits. Often risky investments have high potential ROI values, but the reason is simple: it is intended to compensate for the higher risks. If you want to see the whole picture, you will need to consider the risks along with the Forex returns.

Another aspect is that ROI makes the concept of returns look very simple. It does not consider continuous investments, as if you only invest once and for all, without any further expenses. This is not true in most industries, including trading. You may want to add funds to your account now and again to be able to trade higher lots, or you may encounter commissions or new charges when you try some new instruments for your portfolio. In fact, you may want to pay for some training, and this can also be considered an investment into your trading path.

We also need to remember that ROI is a historical metric, i.e. it only shows the results of a past investment. It cannot be used to predict future profitability. You may choose to believe that if you generally have a trading ROI of 15% over a period of 5 years, the 6th year will be the same. However, this is not always true, as many important factors may affect the value in a year’s time.

All of the above show that ROI cannot be used as the only metric to determine success or failure in investments. To truly see where they stand in terms of financial success, a trader should add more layers of analysis and take into account other factors, such as time or continuous investments. Once a trader understands their ROI for different trading instruments, they may diversify their portfolio to minimize risks and focus on the more profitable instruments.

FAQ

What is ROI in trading?

In trading, ROI (Return on Investment) is the ratio that shows how much a trader has earned or lost versus their initial investment. This value demonstrates the profitability of a certain investment made. If you deposit $500 to your trading account with a broker, such as FBS, and receive $100 of profit, your ROI is 20%.

Can a certain ROI be guaranteed in trading?

Unfortunately, there are no guarantees in trading, including guarantees of some specific returns or profits. Trading is risky. So, while ROI can be impressive here compared to more traditional businesses, such as real estate or government bonds, it implies higher risks, too.

Trading can offer impressive revenue for some very volatile instruments, especially when there are important market events. However, losses are also very possible, even for the exact same assets or instruments. There are no guarantees, you should always estimate and manage your risks.

What average ROI trading can generate

There is no such thing as an average ROI for trading in general or for Forex in particular. With a good trading strategy and some appropriately made trading decisions during high volatility, an ROI of 50% is not unheard of, but still pretty unusual. In fact, investors mostly agree that any positive number is a good ROI. An excellent ROI is 20%, while most active traders are happy with 10-15%.

Summary

Trading is an attractive investment option for people who want to make money online. Many of the assets you trade online (and various derivatives, such as Forex currency pairs) may have very attractive returns on investment. However, everyone should remember that high profitability usually comes with high risks. While ROI can be used to compare different investment opportunities to decide on portfolio diversification, other metrics and tools should be used as well to better evaluate the risks, take time into account, and consider the ongoing costs of an investment.