Each trader must find an approach that aligns with their skills, risk tolerance, financial goals, and level of experience. As with any financial endeavor, continuous learning, adaptability, and disciplined execution are key elements for success in the challenging world of trading.

Glossary

Trend

A sustained price move in one direction. In an uptrend, the price goes up, forming higher highs and higher lows. In a downtrend, it goes lower, forming lower highs and lower lows.

Mean reversion

The idea that when prices move too far away from their average, they often swing back towards it. Traders use this concept when trading against the trend.

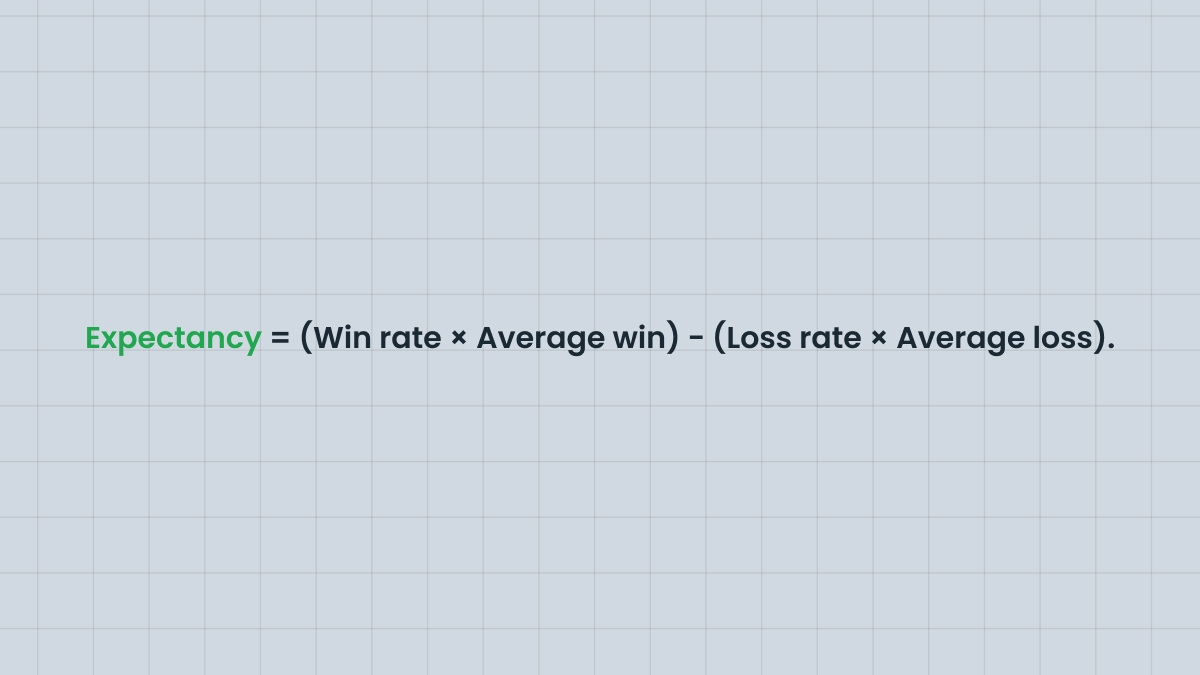

Expectancy

A measure of whether a strategy makes money over time. It combines win rate and average win and loss size into one number that shows the expected profit or loss per trade.

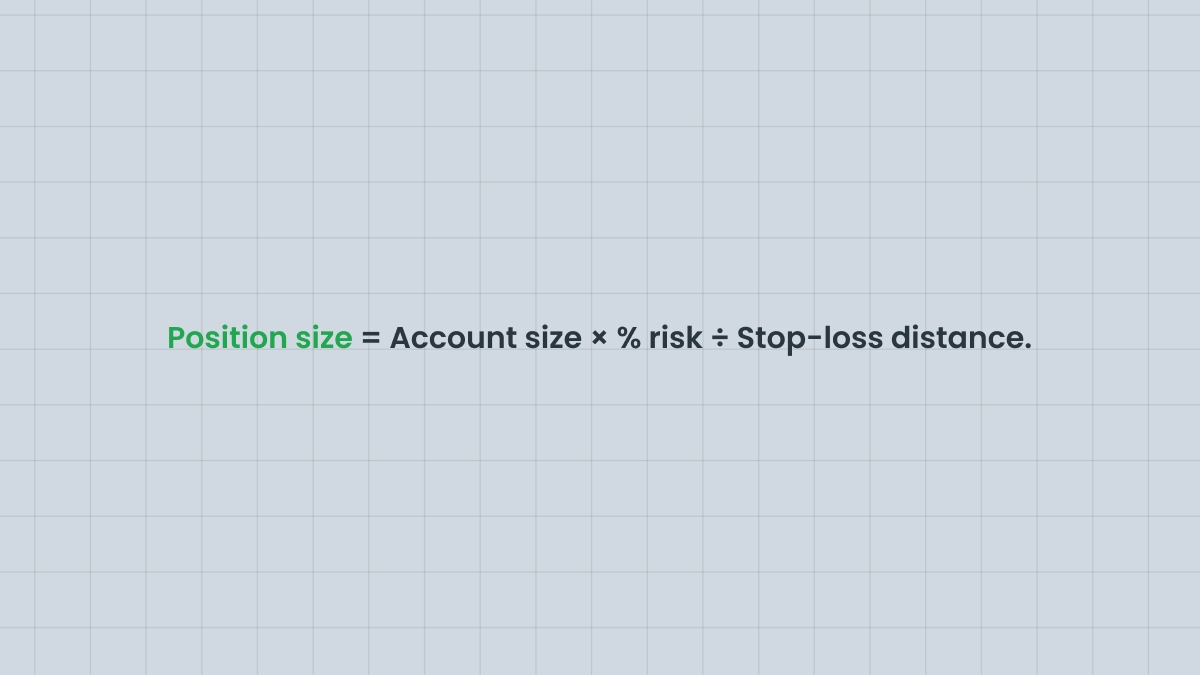

Position sizing

The process of deciding how big each trade should be. It’s usually based on account size, risk percentage, and stop-loss distance, making sure no single trade can wipe you out.

Slippage

When your trade is filled at a different price than expected, often because the market moved quickly or liquidity was thin. It can make losses bigger or profits smaller.

FAQ

What is the 2% rule in trading?

The 2% rule refers to a risk management strategy that suggests risking no more than 2% of one’s trading capital on any single trade. By adhering to this rule, traders can limit their potential losses and protect their money. For example, if a trader has $10 000 in capital, they should not risk more than $200 (2% of $10 000) on a single trade. Following the 2% rule helps maintain consistency in risk management and prevents excessive exposure to potential losses.

What is the 1% rule of trading?

The 1% rule suggests risking no more than 1% of one’s trading capital on a single trade. It’s similar to the 2% rule, but provides even more conservative risk management.

What is a trailing stop-loss?

A trailing stop-loss in trading is an order that adjusts dynamically with the price movement. As the trade becomes more profitable, the stop-loss automatically tightens, securing gains while allowing for potential further upside.

Can stop-loss orders guarantee no losses?

Stop-loss orders cannot guarantee zero losses, but they are a risk management tool designed to limit losses to a predetermined level. Market conditions, slippage, and gaps can impact the effectiveness of stop-loss orders.

What are the main stop types?

Stop order: Becomes a market order once your stop price is hit. You’ll exit for sure, though not always at the exact level you set.

Stop-limit order: Converts to a limit order at your chosen price. You’ll only exit if the market stays within your limit. The risk is that you may not get filled if the price moves past it too fast.

Trailing stop: Trails the price automatically as it goes in your favor, locking in profits while allowing the trade more room to grow.

ATR-based stops: Use volatility (like 2× the ATR) to set distance.

Structure-based stops: Placed beyond recent swing highs or lows.

Where do you place stops?

It depends on your approach. In an uptrend, a trader might put a stop just below the last swing low. If volatility is high, an ATR-based stop gives the trade more breathing space. A short-term trader might use a tighter stop, just beyond the nearest support or resistance. The goal is to set it at a logical price level, not at a random distance.

What are gaps and slippage risk?

A gap happens when the market jumps over prices, often after a weekend or major news. If you had a stop in the gap, it will fill at the next available price, which could be much worse. Slippage is similar but occurs during fast market moves when your order can’t be filled at the exact stop price. Both are normal trading risks. Closing your position before the end of the session or keeping position sizes small helps soften the damage.

When should you adjust a stop?

If the market moves in your favor, you can adjust your stop to break even so that you know you won't lose money with the trade if it fails. If it goes even higher, you can use a trailing stop to follow the price as it moves, locking in current profits. On the other hand, you shouldn’t move your stop further just to avoid it being hit if the price is going the wrong way. This lack of discipline only increases your risk and can lead to big losses.