Common mistakes beginners make trading with leverage

Even when traders understand leverage, many still end up losing money because they keep making the same mistakes. Let’s go over a few of the most common ones and talk about how to avoid them.

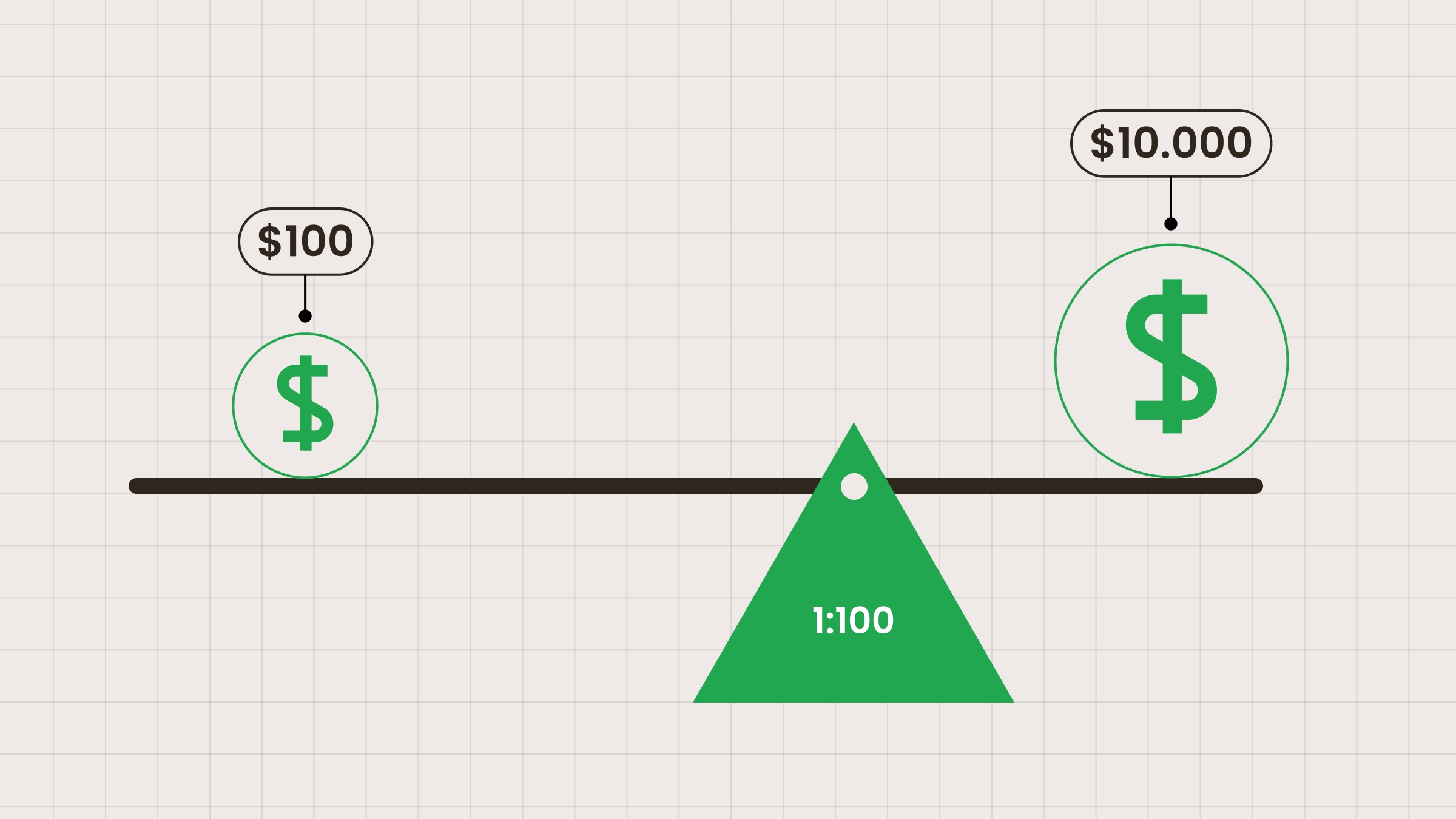

Over-leveraging: Opening trades with leverage like 1:500 or 1:1000 might seem thrilling at first, but it’s dangerous. A tiny 1–2% move against you can wipe out your entire account. It’s better to start small — something like 1:10 or 1:20 — until you can show consistent results.

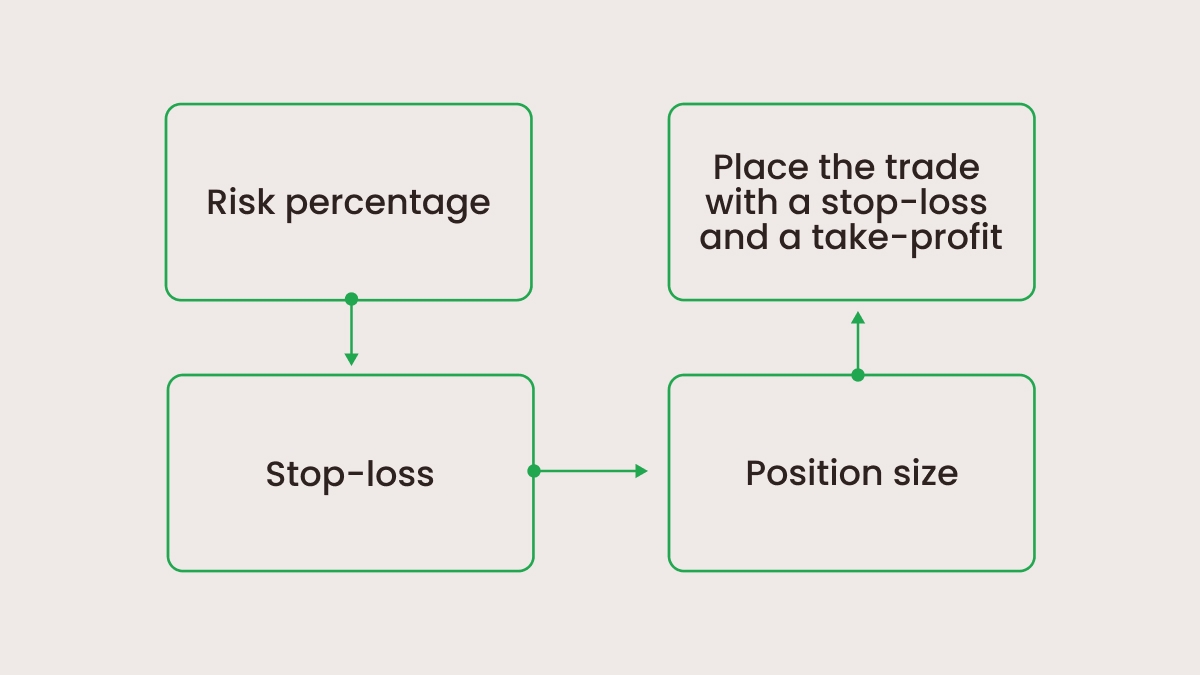

Trading without a stop-loss: One unexpected spike can destroy weeks of progress. Always set a stop-loss before entering the trade.

Chasing losses: After a losing trade, it can be tempting to double the lot size to make the money back. This usually just accelerates the wipeout. Reduce your position size or take a break instead of revenge trading.

Ignoring margin level: Many traders don’t notice when their margin level drops close to 100%, when the broker starts closing trades. Keep your margin level above 300% to be safe.

How to choose the right leverage ratio

Consider the key factors

Your experience: it’s always better to start small. Err on the side of caution and the possible mistakes won’t cost you too much. Increase leverage only after gaining consistent profits.

The account size: sometimes the temptation to use high leverage starting with a small sum is great. Don’t give in, remember that high leverage like 1:500 or 1:1000 can wipe out a small account very quickly.

Your risk tolerance: lower leverage means lower risk per trade. Check out how risk tolerance corresponds to account size:

| Account size | Low risk | Medium risk | High risk |

| $5-$50 | 1:10 | 1:15 | 1:20 |

| $100 | 1:15 | 1:25 | 1:30 |

| $500 | 1:20 | 1:30 | 1:40 |

| $1000+ | 1:25 | 1:40 | 1:50 |

How much leverage you can use depends on where your broker is regulated:

In the EU or UK, retail traders can only use up to 1:30 leverage.

In the US, the limit is 1:50.

Some offshore brokers let you use very high leverage, like 1:500 or even 1:1000.

Leverage ranges by instrument type

Different markets move in different ways. Some stay steady most of the time, while others can swing hard without warning. Use lower leverage when you trade on volatile markets like gold or crypto. Smaller positions give you space to manage losses if prices swing fast. In calmer markets such as major currency pairs, where price moves are steadier and easier to predict, you can use a bit more leverage.

| Instrument | Volatility | Suggested leverage |

| Major FX pairs (EURUSD, GBPUSD) | Low to moderate | 1:10–1:20 |

| Minor or exotic FX pairs | Moderate to high | 1:5–1:10 |

| Gold (XAU/USD) | High | 1:5–1:10 |

| Indices (US500, NASDAQ) | High | 1:5–1:10 |

| Crypto (BTC/USD, ETH/USD) | Very high | 1:2–1:5 |

Leverage ranges for different trading styles

How much leverage you use should fit the way you trade. If you’re the kind of trader who holds positions for weeks, you’ll want lower leverage to stay safe. If you trade more actively, you might use a little more.

Intraday trading (day trading): around 1:20 to 1:50

Day traders open and close positions on the same day. Because trades are shorter and more frequent, a bit more leverage can help amplify returns. However, the danger rises just as fast. Even a small price jump in the wrong direction can lead to big losses if you overdo it.

Extreme leverage like 1:100 or more might look tempting, but it’s not a good idea for beginners or small accounts. Basically, the higher you go, the smaller the mistake it takes to lose your money.