For a beginner trader the temptation to use greater leverage to amplify gains may be strong. However, leveraging is a powerful yet dangerous instrument. How do you choose the best leverage for a small account? Let’s find out!

Leverage: benefits and risks

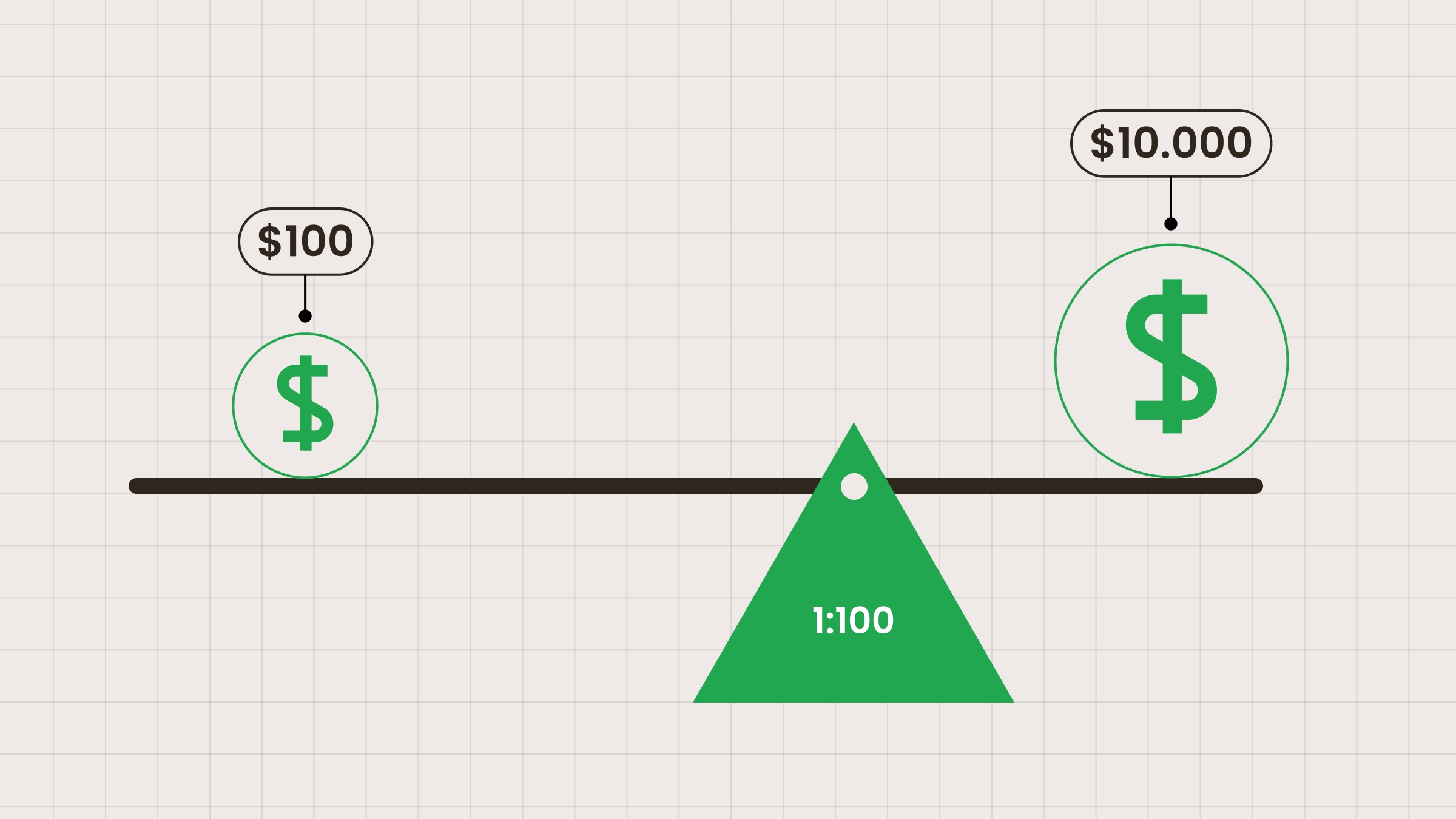

Leverage allows you to control larger trade sizes with a small deposit (margin). But it’s not free capital: essentially you are borrowing money from a broker to enter bigger positions. If you have only $10 in your account, with 1:50 leverage, $10 allows you to control $500. It is crucial to note that while leverage multiplies the profits, it equally multiplies the losses.

Margin is the amount of money your broker locks from your account to open a leveraged position. Think of it as a security deposit — it lets you borrow money from your broker to control a larger trade.

For example, suppose you want to trade 0.01 lots (1000 units) of EURUSD. If your broker’s leverage is 1:50, the required margin is $20 (1000 ÷ 50). So you need $20 in your account to open that trade.