Let’s take a closer look at these characteristics

Brent is a standard for European and Asian markets. This benchmark consists of more than 15 oil grades produced on the Norwegian and Scottish shelf blocks of Brent, Ekofisk, Oseberg, and Forties.

WTI is a mark for the Western Hemisphere. It is sourced from US oil fields, primarily in Texas, Louisiana, and North Dakota.

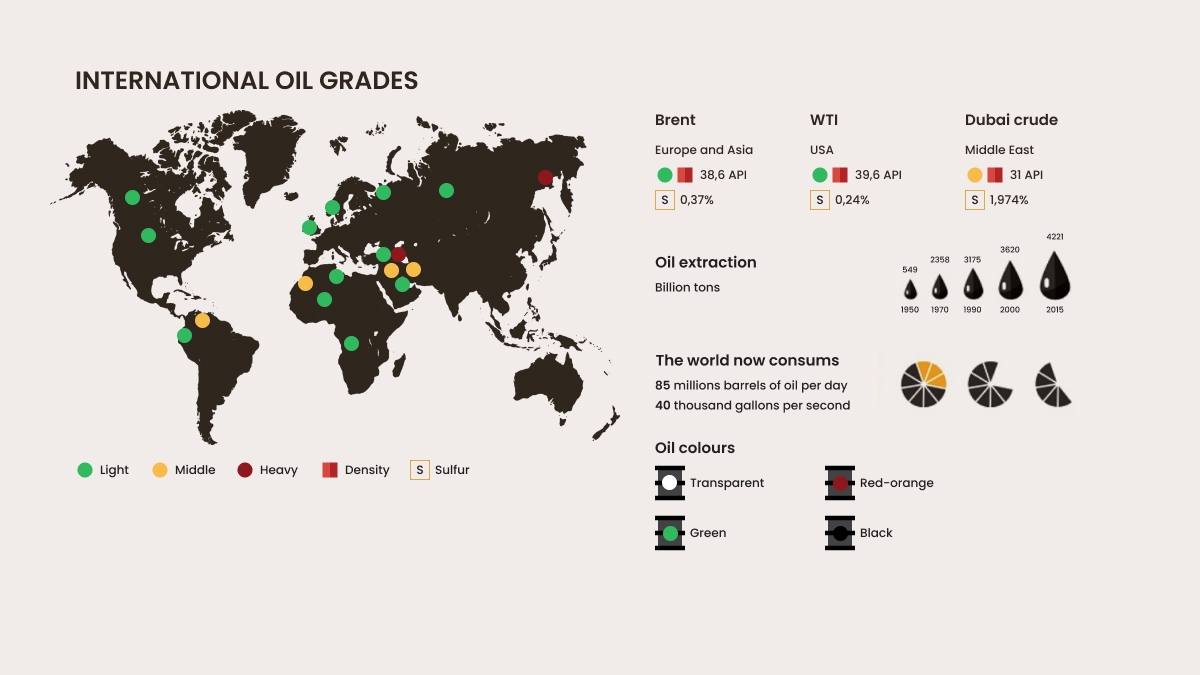

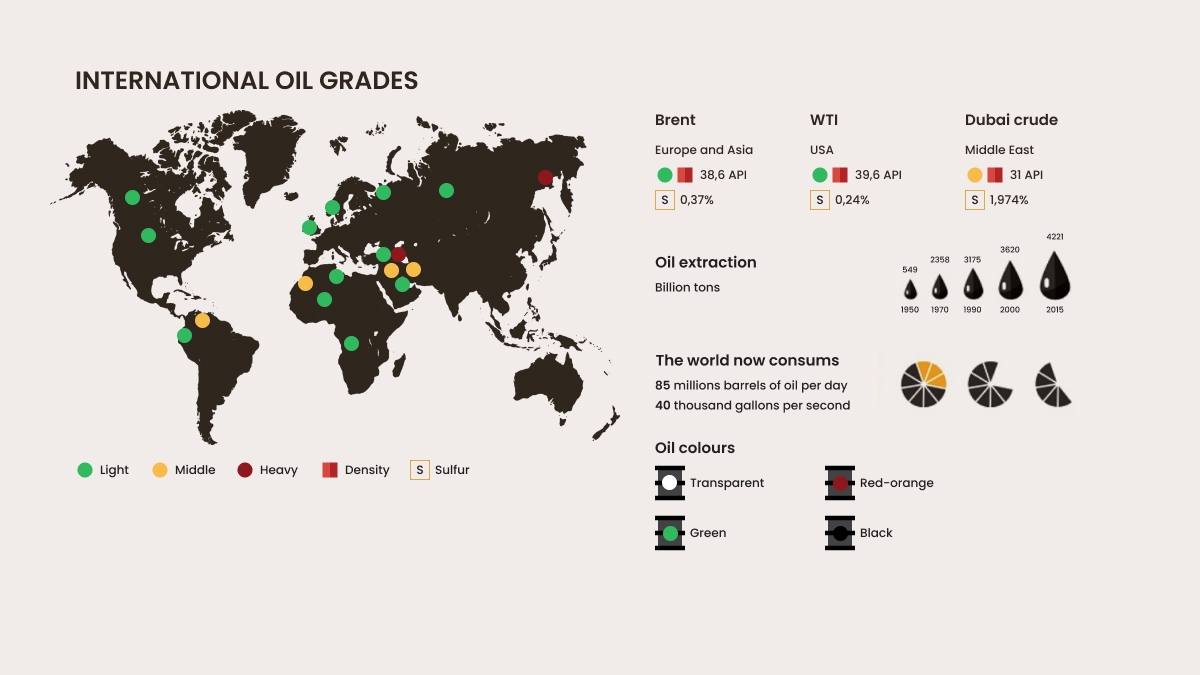

There are no absolutely equivalent oil grades. Even grades that are included in Brent or WTI have a different structure.

Brent is a light type of low-sulfur oil. WTI is a denser oil grade. The quality of WTI is higher than Brent.

Why do Brent and WTI have different prices?

Since the mid-80s, WTI and Brent have traded at almost the same price. There were times when WTI was more expensive than Brent, but currently, Brent is more valuable. The difference in price varies between $10-$20 a barrel.

Mostly, prices depend on the cost of production and delivery.

Brent is produced near the sea, so transportation costs are significantly lower. In contrast, WTI is produced in landlocked areas. As a result, there are infrastructure problems that make it harder to bring surging North American production to the market and as a result, transportation costs become higher.

Another important factor is geopolitical instability. Middle East tensions weigh on oil the most — especially Brent. Tensions lead to a decline in supply. When the supply of any asset declines, prices go up. West Texas Intermediate is less affected because it is based in landlocked areas in the United States.

The price of WTI is formed by crude oil inventories. As soon as the number increases, WTI goes down. If the number of inventories declines, WTI rises. There’s that aforementioned supply issue again.

So as you can see, the major benchmarks are affected by different factors. However, their trends are mostly similar. If Brent goes up, the WTI will go up as well with a high probability.

Summary

Brent and WTI will remain reliable oil benchmarks. If you want to trade on the oil market, choose one of them. However, in choosing one of the benchmarks, remember the factors that affect their prices. By doing that, you will be able to forecast the future price more accurately and your trading will be more profitable.