Bitcoin is consolidating in the $116K—$117K range, with institutional flows through spot Bitcoin ETFs acting as a key price anchor. Year-to-date inflows have exceeded $51 billion, including a record $1.18 billion in a single day, cementing ETFs as a dominant driver of short-term market dynamics. Public company acquisitions have also surged, with corporate purchases in the first half of 2025 surpassing ETF buying volumes.

Regulatory momentum continues to bolster sentiment. A recent US executive order to create a strategic Bitcoin reserve, alongside expanded crypto access in retirement accounts, has deepened institutional confidence in the asset class. On the macro front, softer US inflation data has increased the probability of September Fed rate cuts—historically supportive for Bitcoin—though sticky price pressures could temper the pace of policy easing.

Market Outlook

Price action remains compressed, with Bitcoin trading like a "coiled spring." Support is clustered at $114K—$116K, while resistance sits at $118K—$120K. A sustained break above $120K could open the door to fresh all-time highs, whereas a breach below $114K would raise the risk of an accelerated pullback toward lower support levels.

1. ETF Inflows Remain Key Price Driver

Bitcoin continues to consolidate between $116K and $117K, supported by substantial institutional interest. In 2025 alone, over $51 billion has flowed into spot Bitcoin ETFs, including a record $1.18 billion in a single day—a dominant force in regulating short-term price action. Meanwhile, global ETF and corporate investment now outpace traditional buying routes, with public companies acquiring more BTC than ETF purchases in H1 2025.

2. Regulatory Tailwinds & US Strategic Reserve

Supportive policy developments are buoying bullish sentiment. A recent executive order to establish a US strategic Bitcoin reserve and expand crypto access in retirement accounts has drawn institutional confidence.

3. US Macro Outlook & Price Pressures

Softer-than-expected U.S. inflation data has raised the odds of September Fed rate cuts—traditionally favorable for Bitcoin—although recent inflation surprises may temper the pace of easing.

4. Technical Landscape: "Compressed Spring" Setup

Technically, Bitcoin is in a consolidation pattern—anticipated to act like a "compressed spring." Support sits at $114K—$116K, while resistance hovers in the $118K—$120K zone. A breakout above $120K could pave the way for new all-time highs; a breakdown below $114K would raise the risk of a deeper pullback.

Summary

Bitcoin's near-term outlook strongly hinges on continued ETF inflows, favorable regulatory developments, and US monetary policy expectations. The market sits at a critical juncture—a breakout above $120K may usher in fresh highs, while a slip below $114K—$116K increases downside risk.

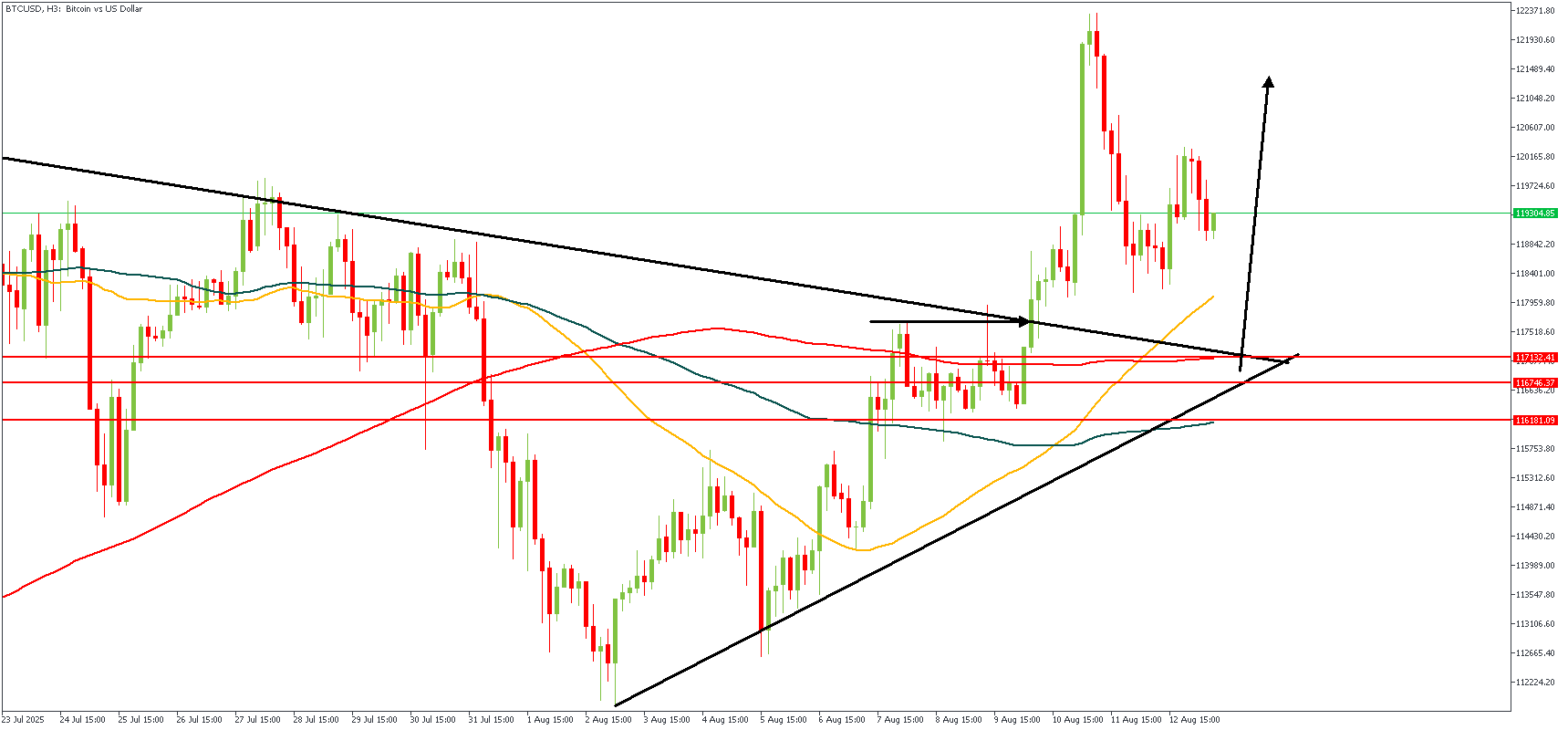

BTCUSD H3 Timeframe

On this BTCUSD 3-hour chart:

Price recently broke out of a descending triangle pattern, confirming bullish momentum with a clean breakout above the descending trendline. This breakout was supported by a strong impulsive candle that pushed price above all major EMAs (50 EMA – yellow, 100 EMA – blue, and 200 EMA – red).

After the breakout, price surged into the $12,200 zone before retracing. Currently, it is pulling back toward the confluence support area near $11,730–$11,680. This zone is significant because:

- It aligns with the retest of the broken descending trendline (now acting as support).

- All major EMAs are starting to slope upward beneath price, offering dynamic support.

- The horizontal level of around $11,730 was previously resistant but has now been flipped into support.

This pullback presents a bullish continuation setup, as long as the structure holds above the trendline and support zone.

Direction: Bullish

Target- 121116.89

Invalidation- 115574.46

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.