Summary

Bitcoin is navigating a consolidation phase following its record-setting surge earlier this month:

- May 28, 2025: Closed at $109,068.50, slipping slightly from the previous day's $109,377.70.

- May 27, 2025: Traded between $109,460 and $110,830, closing at $108,980.

- May 26, 2025: Closed at $109,455.30 after hitting a high of $110,401.40 and dipping to $108,694.00.

These narrow fluctuations suggest Bitcoin is consolidating above the $109,000 zone, potentially setting the stage for its next significant move.

Long-Term Market Outlook

Despite short-term choppiness, sentiment remains broadly bullish. Analysts project Bitcoin could reach $150,000 to $225,000 by year-end, underpinned by:

- Institutional Momentum: Growing adoption through spot Bitcoin ETFs and strategic holdings by major funds.

- Regulatory Tailwinds: Anticipation of crypto-friendly U.S. policies, encouraging broader participation.

- Macroeconomic Dynamics: Ongoing concerns about inflation, interest rates, and sovereign debt fuel demand for digital stores of value.

Risk Reminder

While optimism persists, volatility remains a defining feature of the crypto landscape. Any shifts in regulatory tone, economic data, or risk sentiment could trigger sharp price adjustments.

Key Levels to Watch:

- Support: $108,700

- Resistance: $110,800 and recent ATH at $111,971

- Breakout Trigger: A daily close above $112,000 could ignite a fresh rally toward $120,000+

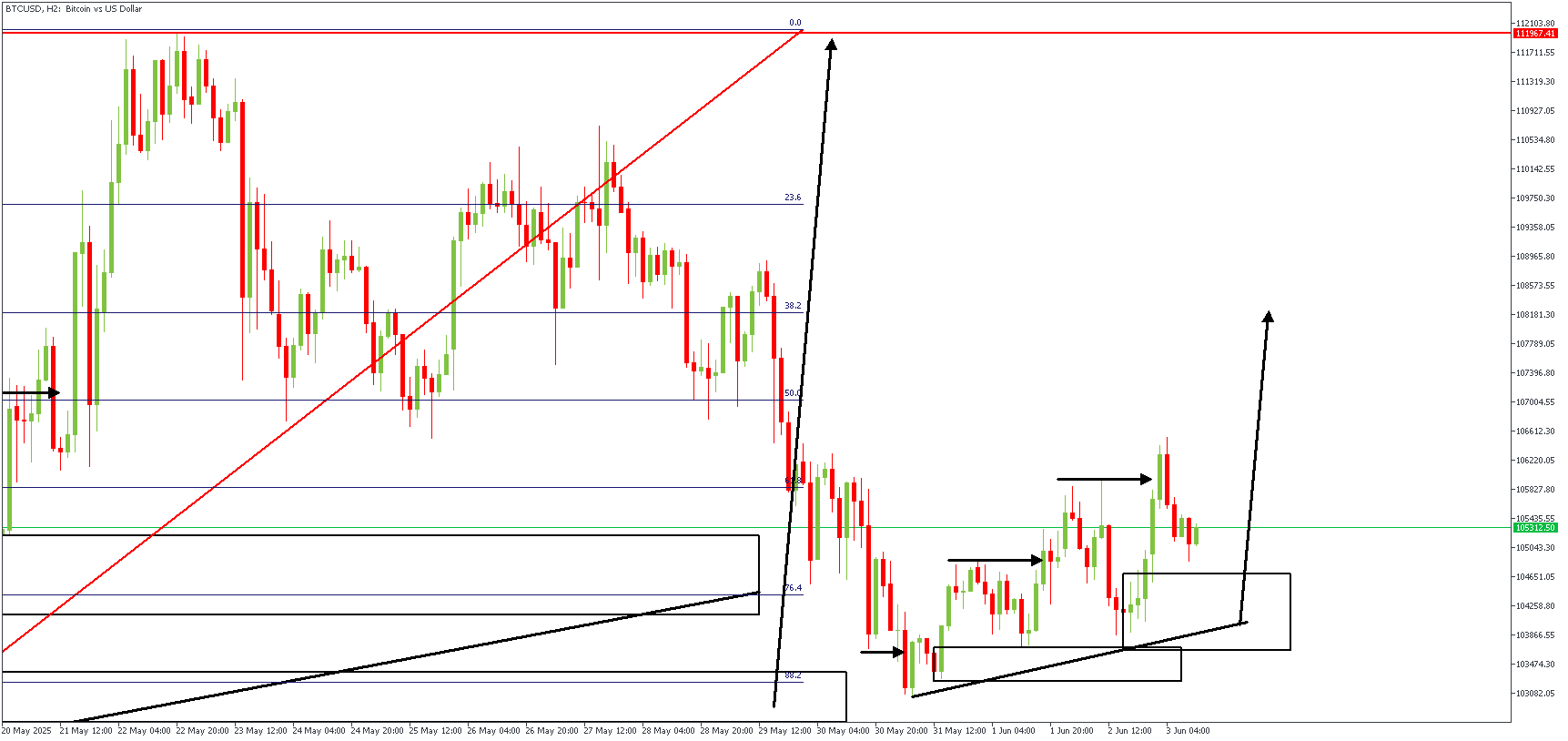

BTCUSD – H2 Timeframe

The 2-hour timeframe chart of BTCUSD shows the price bouncing off the confluence region of the trendline support and the demand zone near the 86% Fibonacci retracement level. In addition, price seems to be completing an SBR pattern, as shown by the bearish sweep of liquidity, which was followed immediately by a bullish break of structure – a double break of structure, in fact. The demand zone of the SBR pattern further strengthens the bullish sentiment since it features additional confluence from a support trendline.

Analyst's Expectations:

Direction: Bullish

Target- 108617.40

Invalidation- 103193.50

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.