İşlem yaparken yapay zeka sohbet robotlarını kullanmanın riskleri ve sınırlamaları

Teknolojiye aşırı güvenme

İşlem yaparken yapay zeka sohbet robotlarını kullanmanın en büyük risklerinden biri, teknolojiye aşırı güvenmektir.

Teknik sorunlar ve aksaklıklar

Yapay zeka sohbet robotlarını işlem yaparken kullanmanın bir diğer riski, doğruluklarını ve güvenilirliklerini etkileyebilecek teknik sorunlar ve aksaklıklardır.

Güvenilir verilerin sınırlı olması

Sohbet robotları öngörü ve tavsiyeler oluşturmak için verilere dayanır ve güvenilir verilerin mevcudiyeti bazı piyasalarda zor olabilir.

Gizlilik ve güvenlik endişeleri

Son olarak, işlem yaparken sohbet robotlarının kullanılmasıyla ilişkili gizlilik ve güvenlik endişeleri vardır. İşlemciler, sohbet robotlarını kullanırken işlem hesaplarının ve kişisel bilgilerinin güvende olduğundan emin olmalıdır.

Yasal düzenlemeler ve uyum hatırlatmaları:

Bir bot veya komut dosyası bağlamadan önce, brokerınızın otomasyon kurallarını kontrol edin.

Yalnızca broker veya borsanızdan onaylanmış veri kaynakları ve API'leri kullanın.

İşlem faaliyetiniz için geçerli olan yerel yasalara ve lisans gerekliliklerine uyun.

Otomatik stratejileri uygulamadan önce platformun hizmet şartlarını inceleyin ve bunlara uyun.

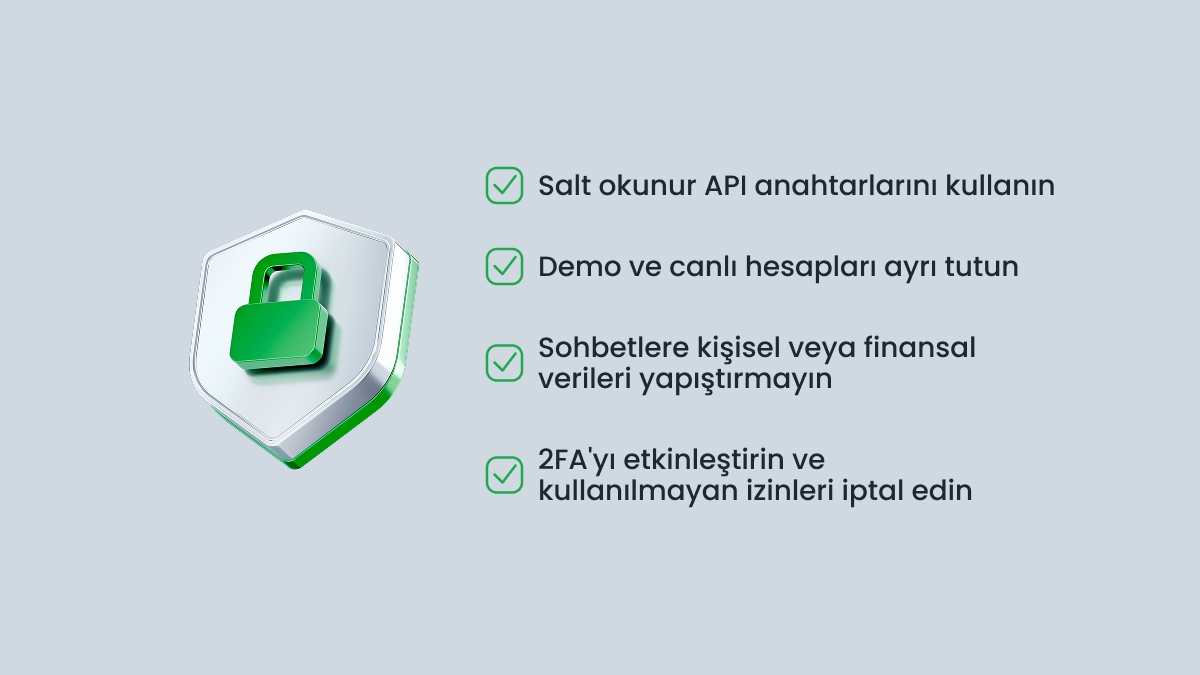

Güvenlik ve veri koruma kontrol listesi:

– Salt okunur API anahtarlarını kullanın.

– Hataları önlemek için demo ve canlı hesapları ayrı tutun.

– Sohbetlere kişisel veya finansal verileri yapıştırmayın.

– 2FA'yı etkinleştirin ve kullanılmayan izinleri iptal edin.

FBS analistleri yapay zeka sohbet robotlarını nasıl kullanır?

FBS analistleri de tıpkı FBS müşterileri gibi, her gün gelişim göstererek işlem becerilerini ve sonuçlarını iyileştirmeye çalışırlar. İşte işlem yaparken gerçek fark yaratabilecek üç önemli bilgi.

1. Bir işlem stratejisi oluştur

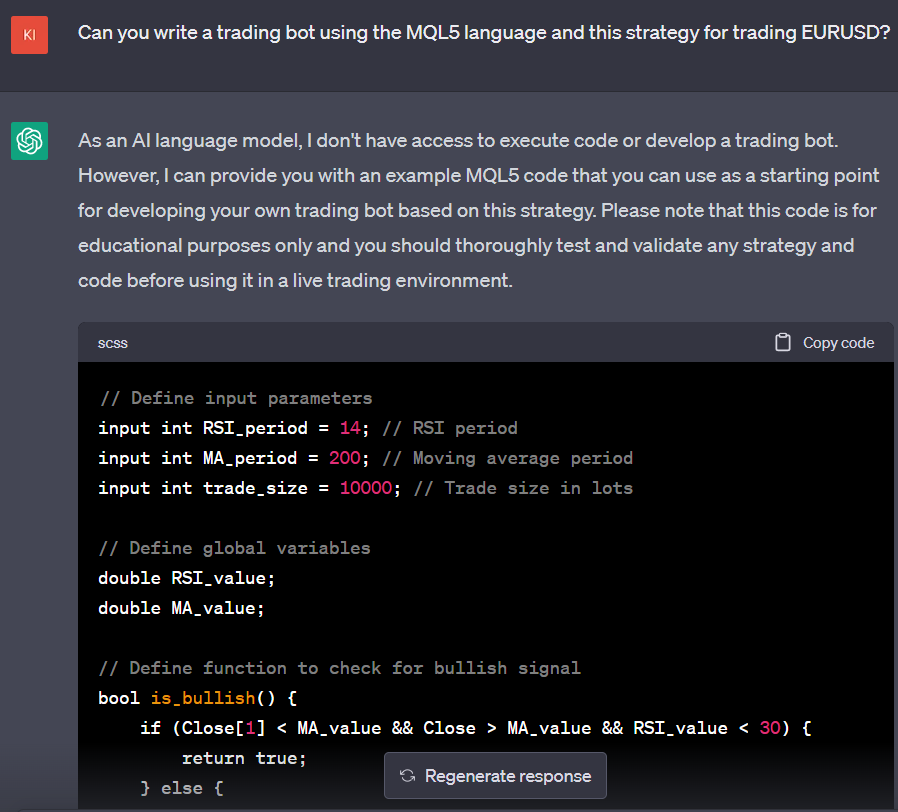

Varsayalım, kullanmayı tercih ettiğiniz iki göstergeye sahipsiniz ve bunları bir işlem stratejisinde nasıl birleştireceğinizi bilmek istiyorsunuz. ChatGPT bu sorunu çözebilir.

İşte bir diyalog:

FBS analisti: Merhaba, sohbet robotu! Lütfen 200 periyotluk MA ve RSI'yı birleştirerek bir işlem stratejisi örneği verin.

ChatGPT: Elbette, işlem stratejileri arasında 200 periyotluk hareketli ortalama (MA) ve Göreceli Güç Endeksi (RSI) kombinasyonunu içeren bir örnek:

200 periyotluk hareketli ortalamayı (MA) kullanarak trendi belirleyin. Trend, fiyat 200 periyotluk hareketli ortalamanın üzerinde ise yukarı yönlü olarak kabul edilir. Fiyat 200 periyotluk hareketli ortalamanın altında ise bu bir aşağı yönlü trend olarak kabul edilir.

RSI'yi kullanarak aşırı alış veya aşırı satış koşullarını teyit edin. 70'in üzerindeki bir RSI okuması aşırı alış durumunu gösterirken, 30'un altındaki bir RSI okuması aşırı satış durumunu gösterir.

Trend yükselişe geçtiğinde ve RSI aşırı satım bölgesindeyken bir yukarı yönlü sinyal arayın. Fiyat 200 periyotluk MA'yı geçtiğinde ve RSI 30'un altına düştüğünde, potansiyel bir trendin tersine döndüğünü gösteren bir yukarı yönlü sinyal üretilir.

Trend düşüşe geçtiğinde ve RSI aşırı alım bölgesindeyken bir aşağı yönlü sinyal arayın. Fiyat 200 periyotluk MA'nın altına düştüğünde ve RSI 70'in üzerine çıktığında potansiyel bir trendin tersine döndüğünü gösteren bir aşağı yönlü sinyal üretilir.

İşlem aleyhinize giderse kayıpları sınırlamak için zarar durdur emirlerini kullanın.

İşlem lehinizdeyken kâr elde etmek için kâr al hedeflerini kullanın.

FBS analisti: Bu stratejiyi kullanarak zarar durdur emrini nereye koymalıyım?

ChatGPT: Bu stratejiye göre zarar durdur emrinizin yerleştirilmesi, risk toleransınıza, piyasa volatilitesine ve işlem hedeflerinize bağlı olacaktır. Genellikle, bir yukarı yönlü işlemde zarar durdur, son salınımın en düşük seviyesinin altına yerleştirilirken, aşağı yönlü işlemde ise son salınımın en yüksek seviyesinin üzerine yerleştirilir. Bu, piyasanın pozisyonunuza karşı hareket etmesi durumunda kayıpların sınırlandırılmasına yardımcı olur.

Bu strateji söz konusu olduğunda, bir yukarı yönlü sinyal oluştuktan sonra uzun pozisyon alıyorsanız, zarar durdur emrinizi son salınım en düşük seviyesi veya 200 periyotluk MA'dan, hangisi daha düşükse onun altına yerleştirebilirsiniz. Bir aşağı yönlü sinyal oluştuktan sonra kısa pozisyon alıyorsanız zarar durdur emrinizi son salınım en yüksek seviyesi veya 200 periyotluk MA'dan hangisi daha yüksekse oraya yerleştirebilirsiniz.

Harika değil mi?