How to massively improve your trading results

Time plays a pivotal role in determining the success or failure of a trade. Traders seeking to enhance their results should focus on time as the most crucial factor.

Best times of day to trade

The best times of day to trade are during specific periods of market activity. The period from 9:30 to 10:30 (Eastern Time) is often one of the best hours for trading, offering big moves in a short amount of time. Volatility and volume decrease around 11:30 (Eastern Time), with the midday being calm as traders wait for further news announcements. From 15:00 to 16:00 (Eastern Time) volatility and volume increase again. During this time, traders often close positions or attempt to join late-day rallies.

Best day of the week to trade

While little evidence supports a market-wide effect, some traders believe in the "Monday effect" or "weekend effect," explaining Monday drops to bad weekend news. Selling on Fridays is strategic to avoid potential losses from Monday dips.

Best months to trade

The turn of the year and summer months are the best times to trade. The "January effect" is when traders return to markets at the beginning of the year, pushing up prices. September and October are historically favored for selling due to September’s weak returns and October’s market crashes.

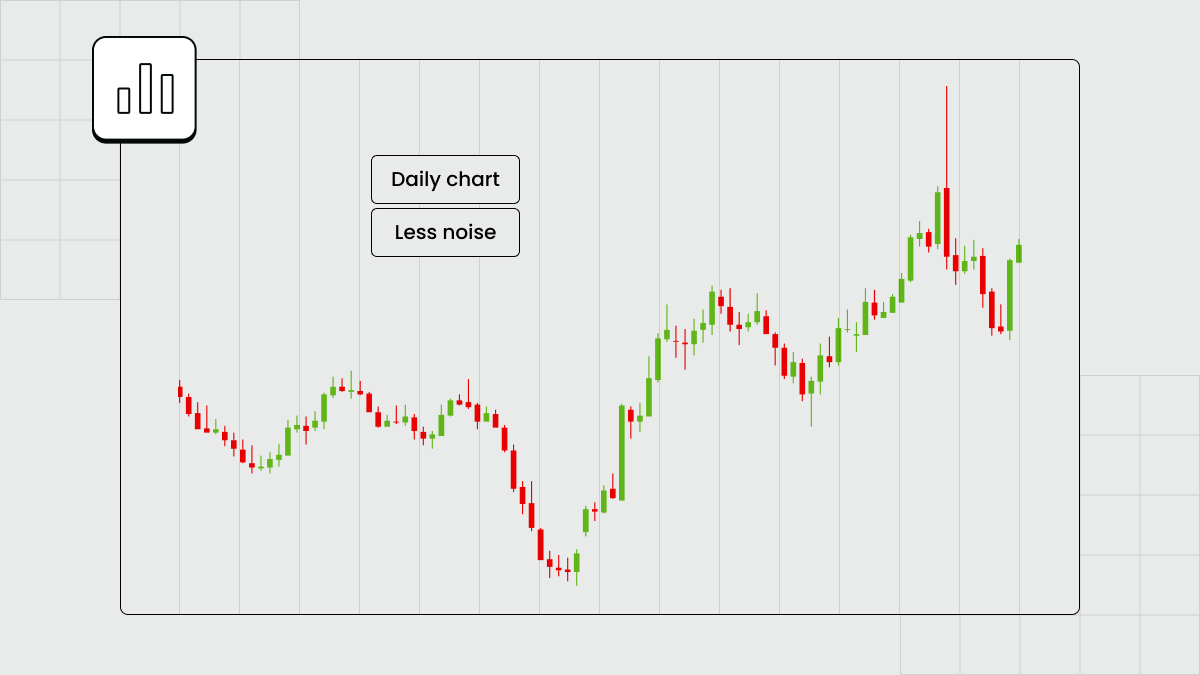

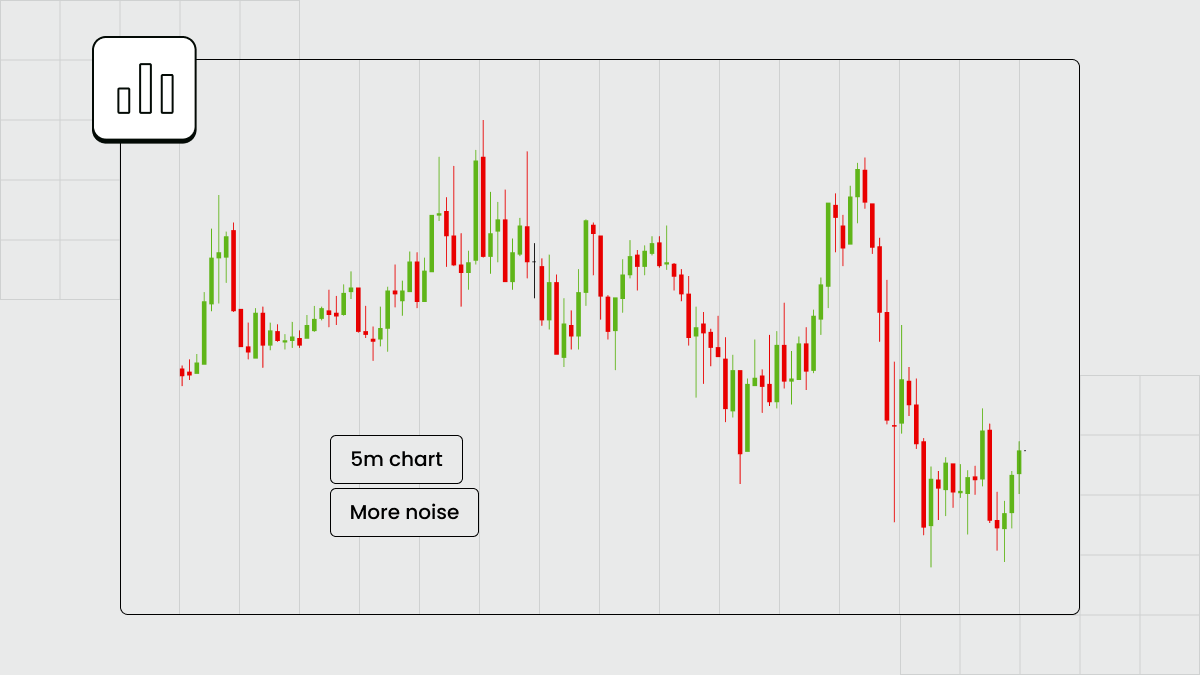

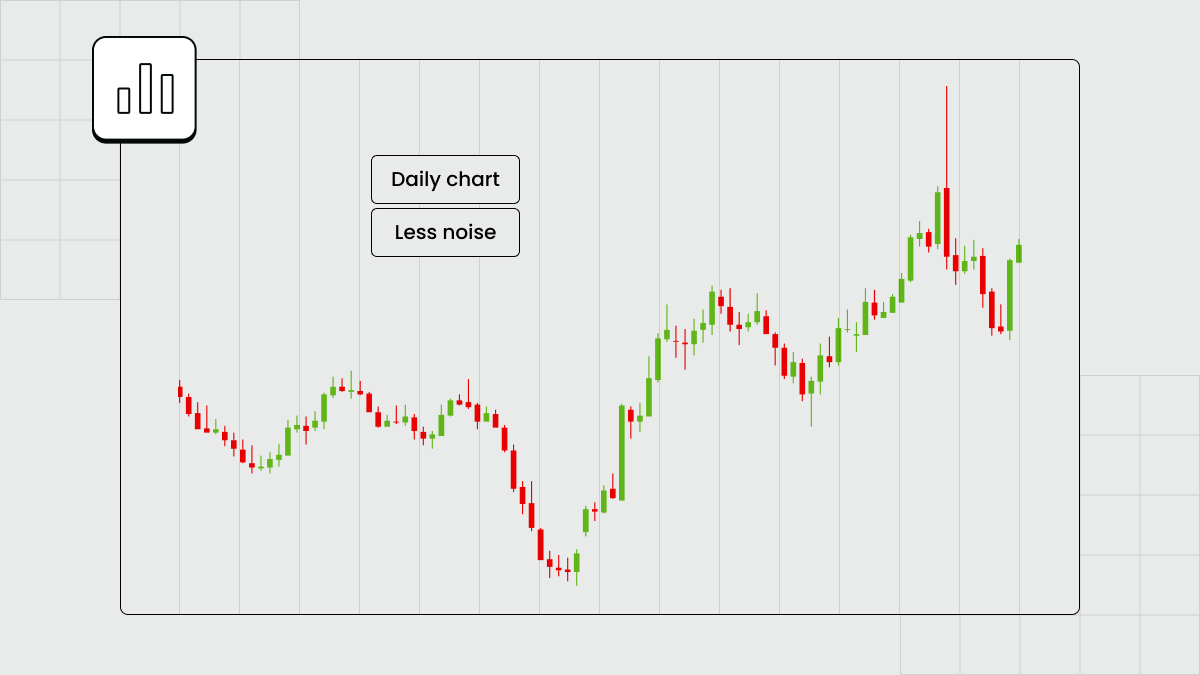

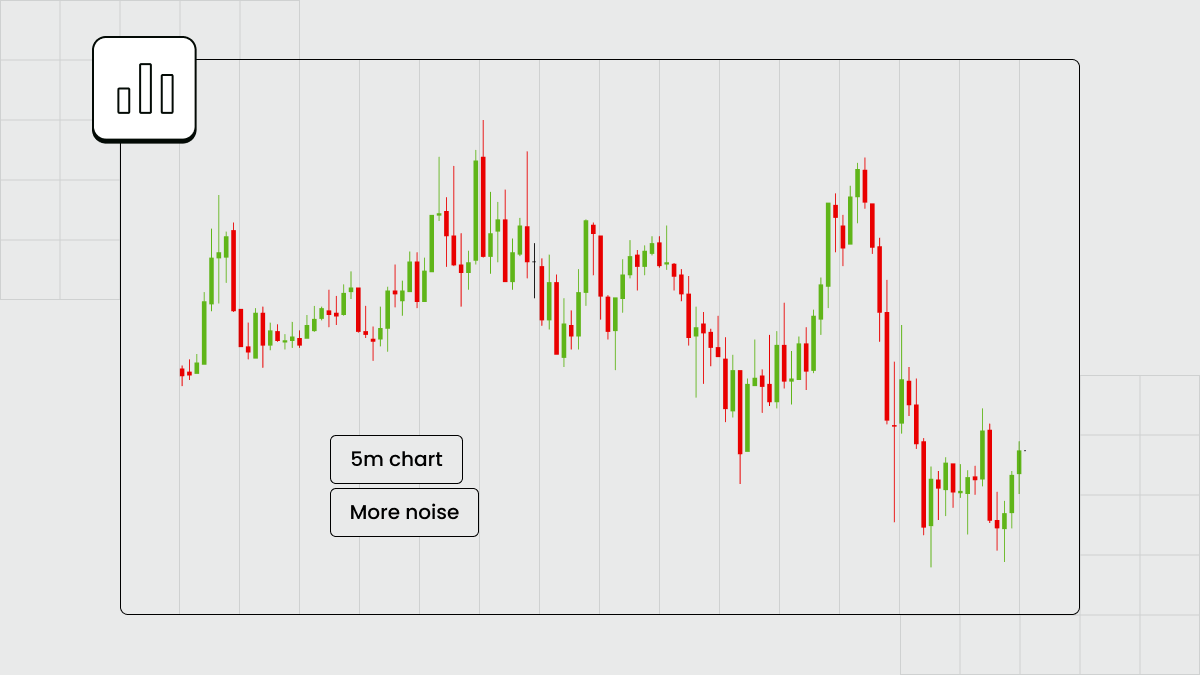

Use wider stop losses and stop meddling with your trades

A wider stop loss implies that a take profit should also be set further away. This is necessary to maintain the risk-reward ratio at a sufficient level. It is advisable to avoid placing stop losses too close, particularly if you set them at some pointless point. Placing a stop loss close to the entry point is only recommended with a valid justification.

At the same time, it is reasonable to set a stop loss further if there are good reasons for doing so. For instance, a wider stop loss is beneficial when an important price level is located there. Cases like this show that increasing stop-loss distances can significantly improve the chances of turning a losing trade into a winner.

Patience and discipline: Do you have them?

The reality is that many successful trades take longer to unfold than initially anticipated. The clash between our desires and the market's trajectory is a common source of frustration. To master forex trading or any financial market, acknowledging and addressing our impatience is crucial.