Morning brief for April 14

All major forex centers are closed today for the Good Friday holiday. Why would normally atheistic profit-seeking financial pundits care about the religious holiday? Well, do you remember about the terrible black Friday’s panic on Wall Street when the gold prices crashed and the US economy had to go through the lengthy period of turmoil? It happened on a Good Friday in 1869. Since then, superstitious Governors vowed never open on a Good Friday again. So, they kept well their promises. The opening almost never happened again (lastly, the NYSE stayed open on a Good Friday in 1907 for some unexpected exceptional reasons).

Anyways, what you need to know is that interest and liquidity will be low today, and trading will be anemic.

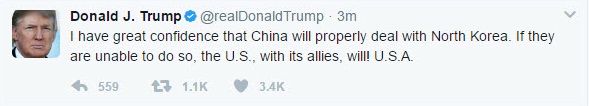

The main topic of yesterday sessions was relative US dollar strength against the basket of major currencies. In Tokyo morning, the later ones managed to recoup some of their losses after US President Donald authorized the bombing of Islamic State positions in Afghanistan adding to geopolitical tensions that sparked on Syrian land (it seems that US leader fell in love with dropping bomb; that’s scary). It also coincided with rising concern that North Korea might conduct its nuclear test on April 15, the date of commemoration of the birth of Kim Il Sung, North Korea’s long-dead founder, and Kim Jong Un’s grandpa. Trump tweeted that the US will try to stop North Korea’s nuclear program unless China manages to target its neighbor via economic sanctions.

EUR/USD sunk to 1.0605 having erased its earlier gains. The next sturdy support can be found at 1.0555 (61.8% Fibo level traced from this year low).

USD/JPY went lower to 108.88 on the risk aversion creeping into stocks that been triggered by the US bombings. A drop below 108.77 (200-day MA) might send quotes lower towards 107.70.

Aussie got off from its yesterday’s high at 0.7595 reached after the strong Australia’s labor market data. On the downside, there is a steady support at 0.7530. A move below 0.7470 will tell us about the restoration of a downtrend.

USD/CAD spiked to 1.3338 overnight in the attempt to win back its weekly losses. The prices spiked upon the release of the Baker Hughes report showing an additional increase in the number of US rigs. Brent oil futures dipped below $55.50 overnight. In the early hours of Tokyo morning, they edged up to $55.90. I just cannot believe that OPEC is going to sit back and watch US oil production rising and dwindling to specks their efforts to curb production and push oil prices higher. But we will keep our fingers crossed for the further extension of November production cut deal.