OIL: down to March levels

Technical

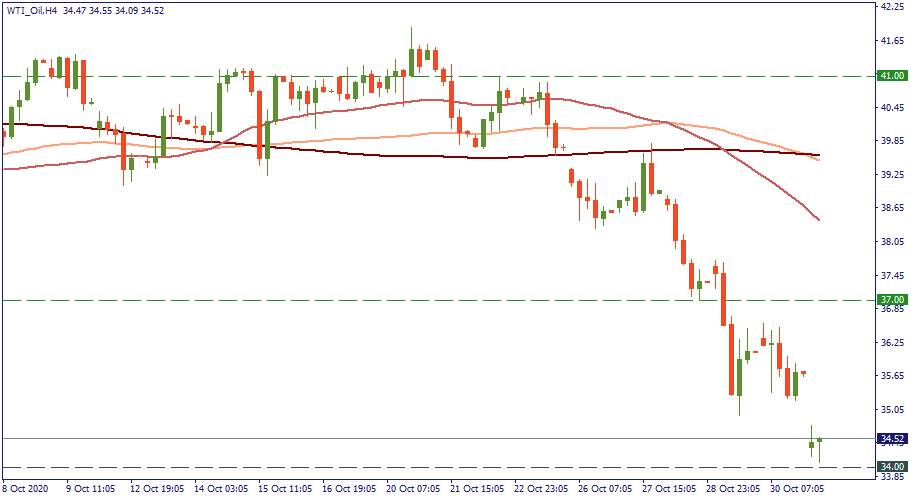

We have seen WTI oil price drop to $35 right before the weekend breaking through local support levels. Today, it almost touched $34 bouncing back up to $34.5.

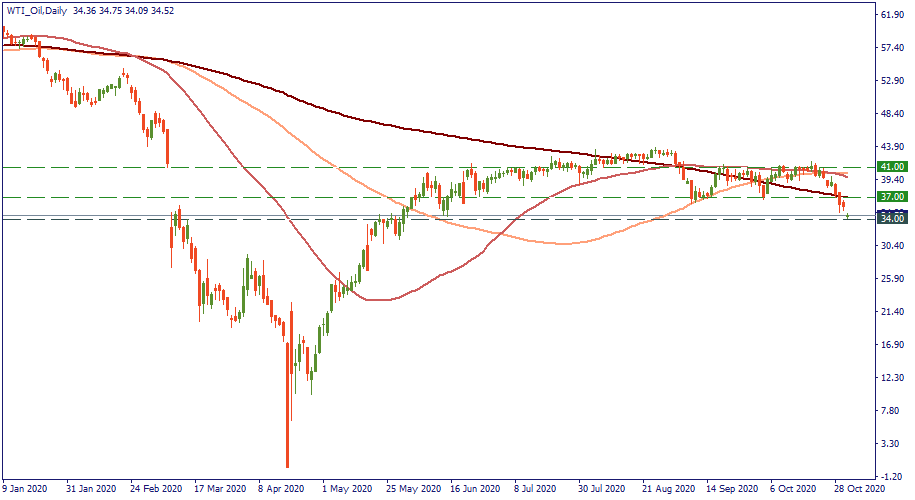

On the daily chart, these levels correspond to June lows and the pre-final-fall zone of March. Which factors are affecting the oil market now?

Fundamental

Just volatility

The oil market trembles on any “hard” news or period, be it good or bad – that’s just because it is more unstable than usual since the virus pushed it out of balance.

Second wave

The current hit of the virus is seen as more significant than many estimated it to be. That’s presses on the expectations of the oil demand recovery.

Joe Biden

Joe Biden is leading in the polls so far. Investors are factoring in this bigger probability into the oil prices now. His plan is to get Iran back to the nuclear accord. It comes with Iran’s 2mln barrels of oil added into the market daily. That will press on the price in the mid-term and will be a problem for OPEC.

On the other hand, Joe Biden plans to “transition” the energy sector from oil to renewable resources – that, in theory, may reduce US oil production, especially shale, and lift the prices in the long term to the joy of OPEC as well.

Conclusion

The oil price now reacts to a set of factors, and you cannot really know which factor comes to the front line at which moment, especially now (before/on the day of the election). After – at least, it will be clear, who the US president is, and one of the factors of uncertainty will be out. So be careful trading it – there may be more movement this week.