Summary

- Resistance Levels:

- EURUSD faces key resistance at 1.1385, followed by 1.1455 and 1.1520. A clean breakout above these barriers could unlock a fresh leg higher in the pair's bullish trajectory.

- Support Levels:

- Immediate downside protection is seen at 1.1290, with deeper support at 1.1230 and 1.1180. A close below these could flip sentiment bearish.

- Trend Indicators:

- The pair exceeds its 200-day Simple Moving Average (SMA), underscoring a long-term uptrend. Momentum signals like the RSI and MACD remain aligned with bullish continuation.

Fundamental Drivers

- U.S. Dollar Dynamics:

- While the greenback has shown broad weakness amid fiscal jitters and mixed data, a rebound sparked by upbeat consumer confidence has lent it temporary strength.

- Eurozone Outlook:

- The ECB remains cautious, striking a balance between inflation and growth. However, the latest PMI data, showing business activity slipping to 49.5 in May, reveal that business activity is under pressure.

- Geopolitical Relief:

- The U.S. decision to pause tariffs on the EU has reduced trade tensions, offering a mild tailwind for the euro.

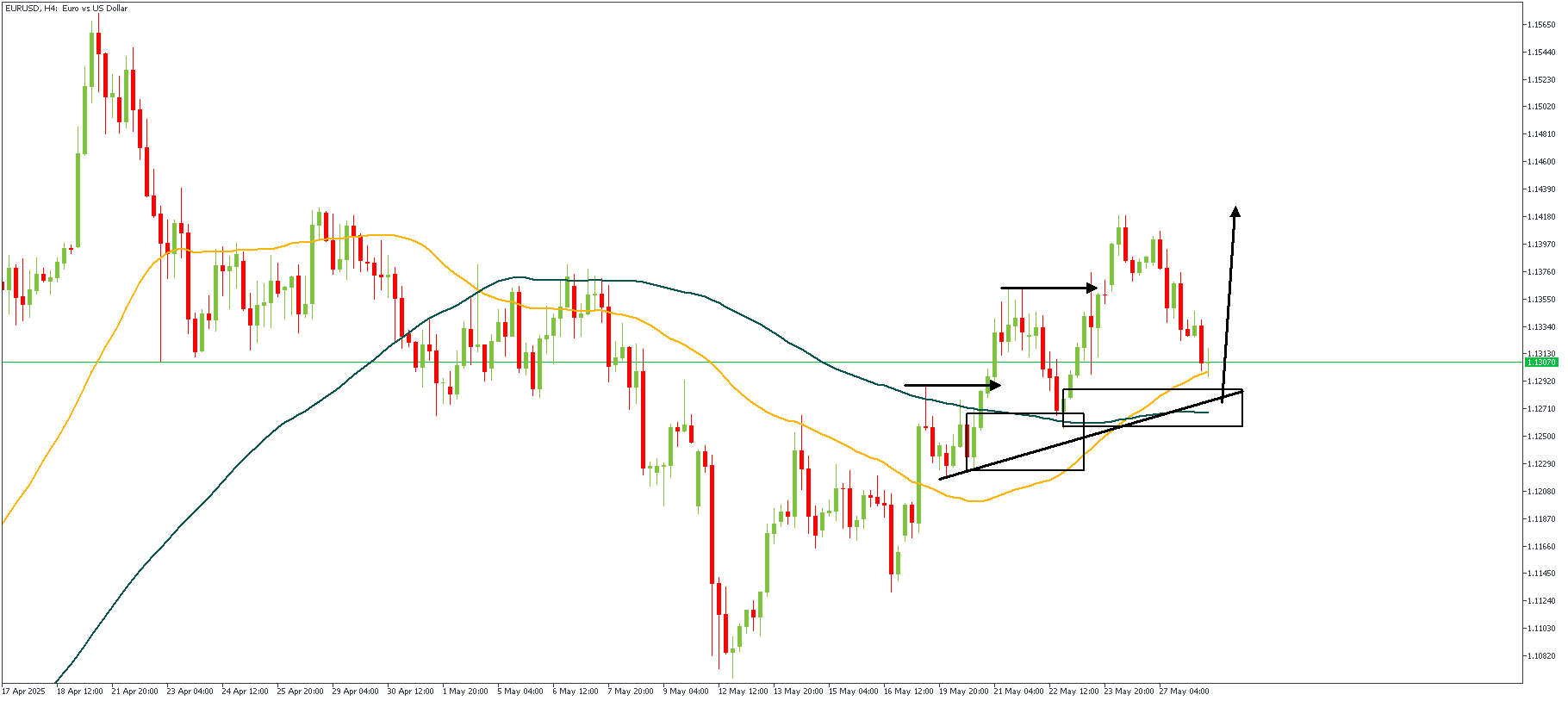

EURUSD – H4 Timeframe

The EURUSD 4-hour timeframe chart recently completed a bullish break of structure, with price overshooting the 100-period and 200-period moving average resistance. The ongoing retracement has reached the demand zone responsible for the bullish breakout, while the trendline and moving averages also now serve as a support region for price and a confluence for the bullish sentiment.

Analyst's Expectations:

Direction: Bullish

Target- 1.14198

Invalidation- 1.12435

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.